The price of goods and services in Canada is increasing, causing inflation to become more of an issue. For example, in 2020, the annual inflation rate was low at 0.7%. But then it rose to 3.4% and 6.8% in 2021 and 2022, respectively. Currently, inflation in Canada is 5.2%, as measured by the Consumer Price Index (CPI, as provided by Statistics Canada).

Canadians are feeling the economic and purchasing power effects of inflation. This effect has many cutting back on their spending habits to reduce costs. Budget shopping is one way to manage the cost of living as Canada's inflation rate continues to affect the country.

In this article, we explore the fundamentals of inflation in Canada. We also discuss ways to help you manage and reduce its effects on your finances through budget shopping.

What is inflation?

Inflation is the steady rise in the cost of products and services in a given economy. It is typically evaluated using an inflation index in Canada, such as the Consumer Price Index (CPI). The CPI measures the prices of various goods and services over a given period.

Inflation is healthy for an economy if it rises in a measured and consistent way. But a rapid rise in the CPI drives interest rate hikes that reduce a country's overall economic activity and, potentially, growth.

How does inflation affect the economy?

Inflation can drastically affect the economy. It reduces the ability of people to buy goods and services when the cost of living rises more quickly than wages.

When consumer spending decreases, it can hurt economic growth. Additionally, inflation can push up interest rates, making it more costly to borrow money and causing people to invest less.

What factors contribute to inflation in Canada?

Canada's goods and services cost is subject to various contributing elements. For example, when demand exceeds the supply of goods and services, prices inevitably rise and cause inflation.

The cost of production, such as wages, materials, and energy, also affects inflation. If the cost of production increases, businesses may increase the prices of their goods and services. They do this to maintain their profits, leading to inflation.

Government decisions, including changes in taxes, subsidies, and regulations, can affect inflation. For instance, increasing taxes on businesses can lead to a rise in customers' prices, thus driving inflation. Likewise, changes in exchange rates and global commodity prices can also influence inflation in Canada.

How to assess your financial situation

Having gained a better understanding of inflation in Canada, the next step is to assess your current spending habits. This assessment will help you build a budget that considers the effects of inflation. Examining your financial situation is essential when planning to reduce expenses during periods of high inflation in Canada.

By following these suggestions, evaluate how you use your money and identify where you can reduce expenses.

- Review your bank statements and receipts: Reviewing your bank statements and receipts from the last few months can be beneficial. This review allows you to see where you are spending the most money and where you could reduce your costs.

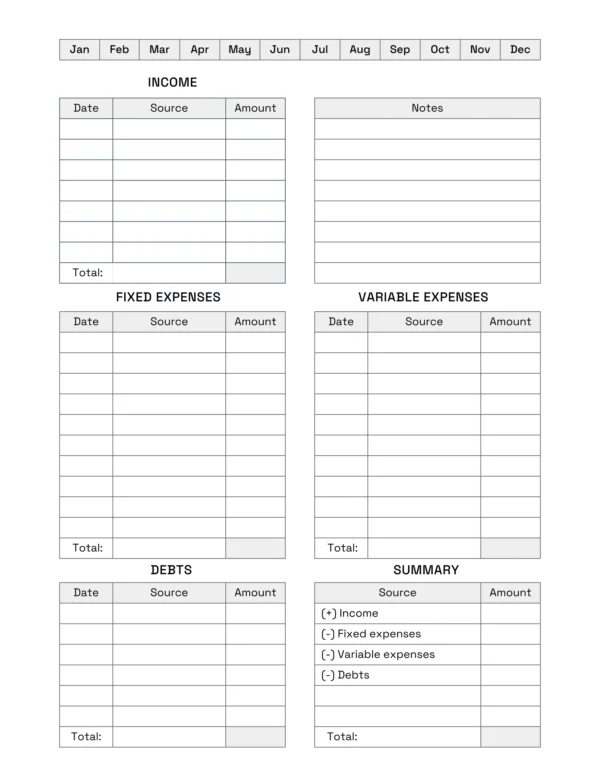

- Track your expenses: Use a budgeting program or spreadsheet to track your spending. This will help you identify where your money is going and determine any overspending.

- Determine fixed expenses: List recurring expenses such as mortgage payments, insurance, and utilities. Then, subtract them from your monthly income to specify the money you have left for discretionary (fun!) spending.

- Determine unnecessary (discretionary) spending: Identify any nonessential spending and create a budget for each type of expense to avoid wasting money.

- Prioritize your spending: Organize your expenses in order of importance. For example, if you value travelling, you could reduce the money you spend eating out to save for a potential trip.

- Look for saving ideas: Explore ways to cut costs in your budget. These ideas may include switching to a less expensive mobile/cellular service, shopping at discount stores, or minimizing energy consumption.

How to build a better budget

Evaluating existing spending is the first step in creating a successful budget while shopping in Canada. Establishing a budget is critical for controlling finances, allowing you to save for the future while minimizing debt.

These guidelines make budgeting easy.

Set financial goals and priorities

First, determine your financial priorities and goals to start budgeting effectively in Canada. These could include paying off debt, saving for retirement, purchasing a property, or taking a vacation. Next, figure out which goals are the most important to you and order them in order of priority.

Create your budget plan

Then, use the income and expenses information you collected in the above sections. Remember to include things such as clothes, gifts, and travel. Next, deduct your expenses from your after-tax income to see what you have left. Utilize this remaining income to save for and realize your financial priorities and goals.

The internet is full of budgeting resources, some of which require payment. Budgeting doesn't need to cost anything or be complicated. Identify your income and expenses, then reduce spending to increase your leftover funds. It's really that simple!

Stick to your budget

Being disciplined with your budget can be challenging. But there are methods to make it easier, such as the following tips.

- Use cash/debit cards instead of credit cards. This approach pushes you to stick to the cash in your bank account and reduce debt.

- Set up automatic transfers to your savings account. Immediately separating your savings from your income will significantly improve the chance you'll save money.

- Avoid impulse purchases. Take a day to think about your purchases. It is amazing how often a twenty-four-hour cooling-off period will drive down your spending.

- Regularly review and track your budget. You're more likely to follow your budget if you track it.

- Use budgeting apps. These applications will help you visualize your spending, allowing you to dig deep into your habits and lower your monthly outgoings.

- Find free or low-cost activities. Go for a walk or read in a park. Pack a sandwich and enjoy a picnic.

- Set realistic goals. Do not set yourself up for failure by setting unrealistic goals. Small plans can be built into greater goals. Be patient.

- Find ways to increase your income. If you have extra time, there are a bunch of side hustles out there. Earning more will help you realize your financial goals much more quickly.

- Create a buffer in your budget for unexpected expenses. An emergency fund is the best option. But saving up at least a month or two of expenses can help you in a bind.

Tips and tricks for budget shopping in Canada

Exploring budget shopping in Canada can offer numerous advantages. These can include becoming more conscious about your spending and frugal. Here are helpful tips and tricks for saving money while shopping in Canada.

- Buy in bulk: If you want to save money on items such as toiletries, cleaning supplies, and dry goods, consider purchasing them in larger quantities. Many warehouse stores (e.g., Costco) offer reduced-priced bulk items, so it's an excellent option for saving money.

- Choose generic and store-brand products: Opting for generic or store-brand items can be a great way to save money without sacrificing quality. This is especially true regarding basic staples such as flour, sugar, and salt.

- Shop around for the best deals: Especially if you're making a major purchase, take the time to compare seller prices and find the best deal. Affordable prices are everything.

- Clip coupons: Yes, this actually works. Many grocery and retail chains offer print and digital coupons. 20% here and $2.00 off there adds up quickly. Coupons lead to great-priced items.

- Shop at a discount and thrift shop: Save money by shopping at reduced-price and second-hand stores. These places provide fantastic bargains on clothing, home goods, and furniture. You can get good quality items at much lower prices than usual. You may even find designer clothing and shoes.

- Plan meals to reduce food waste: Creating a weekly menu can help you save money and reduce the amount of food that goes to waste. Make a list of meals ahead of time and purchase only the necessary ingredients for those meals to avoid extra trips to the store.

Make smarter choices in your home

Given the recent inflation surge in Canada, saving money by making cost-effective decisions for your household is a good idea. Here are some ideas for doing so.

- Energy-efficient appliances/products: Energy-efficient appliances are an excellent way to reduce expenses. These items can significantly reduce energy consumption, leading to cost savings on your monthly utility bills. For instance, an energy-efficient fridge can help you save up to 20% on your electricity bill.

- Reduce water usage: Reducing water consumption can be a great way to save money. This can be done by installing low-flow showerheads, fixing dripping faucets, and adding water-efficient toilets.

- Enjoy some natural light and install energy-saving lightbulbs: Let the sun's rays into your home instead of relying on artificial lighting. Switch to energy-efficient LED bulbs to reduce your energy consumption by up to 80%.

- DIY projects and repairs: Rather than paying for a professional to do it for you, you can take on basic maintenance and renovations by yourself to save on labour expenses.

Invest in the future

In light of Canada's rising prices and expenses, it is important to consider long-term investment strategies to ensure financial stability in uncertain times. There are multiple options available to do this.

Save for emergencies

Canadians should create a savings fund for emergency and unanticipated expenses to minimize financial strain in uncertain times. This can provide security if unexpected events like job loss or health problems occur.

Contribute to retirement funds

It is essential to start saving and investing early to ensure a comfortable retirement. Contributing to retirement funds is a vital part of this planning process.

Canadians can benefit from saving for the future with Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs). Making regular payments into these funds is a great way to take advantage of compound interest and increase their savings gradually.

Invest in stocks and other assets

Canadians have the potential to increase their financial success in the future through investment in stocks and other assets. This gives you a chance to accumulate wealth in the long run. You can use your TFSA for this purpose.

It is essential to be aware of the risks of investing. Canadians can reduce these risks by spreading out investments (hedging), conducting thorough research, and investing long-term.

Summary

The economic effects of inflation can be far-reaching, reducing citizens' buying power, hindering development, and making it harder to take out loans. In Canada, the causes of inflation are multi-faceted. They include the demand for products and services, the cost of production, governmental regulations, and other economic factors.

Budgeting can be a viable option to manage inflation-driven increased cost of living. To make this a reality, you must take stock of their spending and identify areas where they can cut costs. You must also monitor your expenses, distinguish between necessary and unnecessary expenditures, and prioritize your spending. Organizing a formal budget and setting financial objectives will help you stay on track.

You can save money by opting for bulk purchases and store-brand products. You can also make good decisions for your home, including investing in energy-efficient appliances. Pairing this with long-term plans, like investing in stocks, can help protect against the effects of inflation in Canada.