In Canada, it is important to begin saving money in your twenties. Creating a solid financial base allows you to become self-sufficient and reach your long-term goals. In addition, taking control of your financial situation early will lead to a more prosperous financial future.

Financial security in your twenties can help you accomplish what you want out of life. This might include travelling, getting married, having kids, or starting a business.

This article explains how to manage your finances during your twenties. It suggests following some basic rules and having a bit of self-control. However, it also encourages you to make the most of your twenties after setting up a financial plan.

The importance of financial planning in your twenties

A simple internet search for “examples of bad financial advice online” will provide a significant and somewhat hilarious return. It is unfortunate when Canadians are taken advantage of and lose hard-earned money as a result of obtaining misguided advice. Therefore, when you begin your budgeting journey, avoid the unknown and stick to reliable and proven financial planning advice.

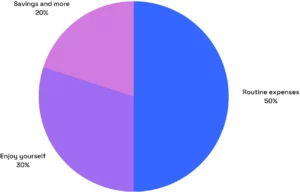

The 50/30/20 rule

To stay ahead of your future, consider following the 50/30/20 rule. U.S. Senator Elizabeth Warren popularized this approach. This basic rule suggests the following:

- Dedicate 50% of your income after taxes to necessary payments like your typical bills (needs).

- Set aside 30% of your post-tax earnings to treat yourself. For example, spend an evening with friends or pamper yourself with a relaxing spa experience.

- Put aside 20% of your taxed earnings for saving, investing, and advancing your learning (financial reserves and growth).

This approach may not be suitable for everyone, but it can be adjusted to your personal situation. If you have larger monthly payments, you may want to consider a 70/20/10 rule instead.

The takeaway is that you should clearly understand how much you earn and how much you should save, spend, and invest. This step is the first towards financial freedom.

Developing good money habits for a strong financial future

It’s important to develop your financial literacy. You should know where your money goes. You should also know where you can adjust to reach your financial goals. Make these improvements to achieve success.

1. Create a budget and track your expenses

Budgeting plays a crucial role in maintaining financial stability. It also fosters a sense of control over personal finances. Creating a well-structured budget allows you to track your income and expenses effectively. You can then make informed decisions about your spending habits.

Financial discipline helps prevent overspending and the build-up of debt. It also promotes a culture of saving and investing for future goals such as education, retirement, or homeownership.

Budgeting is fundamental in nurturing financial literacy and empowering you to lead more prosperous, stress-free lives.

Tips for creating a budget

- Set clear financial goals: Begin by identifying your short-term, mid-term, and long-term financial objectives. These goals will help you stay focused and motivated while budgeting.

- Track your income and expenses: Record all sources of income and categorize your expenses to understand where your money is going. This will help you identify areas where you can cut back or adjust.

- Create a realistic budget: Develop a budget that suits your needs and lifestyle based on your tracked expenses. Allocate funds to essential categories, such as housing, utilities, groceries, transportation, leftover spending, and savings.

- Prioritize savings and debt repayment: Allocate a portion of your income to build an emergency fund. Save for future goals and pay off high-interest debt. Putting these elements first can greatly improve your financial stability and well-being.

- Monitor and adjust your budget regularly: Regularly review your budget to ensure you are staying on track. Adjust as needed to accommodate income, expenses, or financial goals changes.

- Utilize budgeting tools and apps: Use budgeting tools or apps to simplify the process. With these apps, you can track expenses, set goals, and monitor your progress. These tools can help you stay organized and accountable.

- Practice mindful spending: Be conscious of your spending habits and consider the long-term impact of your purchases. This can help you make more informed decisions and avoid impulsive buying.

- Cut back on non-essential expenses: Identify areas where you can reduce spendings, such as dining out, entertainment, or subscription services. Redirect these funds towards savings, investments, or debt repayment.

- Build a financial buffer: Create a cushion to cover unexpected expenses or income fluctuations. Reduce the need to rely on high-interest debt in emergencies.

- Seek financial education and advice: Constantly educate yourself on personal finance topics. Consult a financial professional for personalized advice and guidance.

Recommended budgeting apps and tools

Apps like Mint and YNAB have completely changed how people manage their finances. These tools make it easier to keep track of your income, set financial goals, and check progress as it happens.

Mint and YNAB automate various aspects of budgeting and offer insightful information. They empower users to make informed financial decisions with greater ease and confidence. Moreover, these apps sync with multiple financial accounts, enabling a comprehensive view of your financial situation.

Budgeting tools like Mint and YNAB are invaluable resources for cultivating personal financial awareness and ensuring long-term well-being.

2. Build an emergency fund

An emergency fund lets you focus on what is important: getting through the event.

Creditpicks

Tweet

Having a backup source of money can be a lifesaver in difficult situations. These situations might include losing your job, paying medical bills, or dealing with car repairs. This extra cash can help protect you from the stress of incurring debt for emergencies.

Reasons for having an emergency fund

An emergency fund can provide security in case of unforeseen events, like home repairs. It differs between a reasonable financial “hit” or a catastrophe in an emergency. These situations are stressful enough; worrying about money should be secondary to the unfolding event.

An emergency fund lets you focus on what is important: getting through the event.

How much to save in an emergency fund

The amount of money you should save for an emergency fund can vary based on your personal and financial situation. Generally, it’s recommended to have three to six months of living expenses saved away to cover any sudden costs. This should consider things like job security, income stability, and whether you have dependents or any outstanding debts.

It is important to regularly contribute to your emergency fund. You should also review your circumstances and the fund every three months to ensure you account for all outcomes.

Strategies for building an emergency fund

Establishing an emergency fund involves methodically putting money away.

Begin by deciding on a definite amount of money you want to save. This amount should be based on your expected expenses over your selected period of time (e.g., 3-6 months). Create a feasible timeline for reaching the amount. Specify a percentage of your income regularly to be moved into a distinct, readily available savings account.

To reach your goals faster, think of ways to increase your available income. This might include cutting back on spending or finding other sources of income. Keep checking and changing your savings plan to stay on track.

3. Pay off high-interest debt

Many young adults have student loans, credit card debt, or other forms of debt. Saving money in your twenties can help you pay off high-interest debt faster. It can also reduce financial stress and improve your credit score.

Understanding high-interest debt

Many Canadians live their entire lives in debt. According to the Bank of Canada:” The vulnerability associated with elevated household indebtedness […] is significant and has increased over the past year. This vulnerability has built up over the past two decades as a growing share of Canadian households have accumulated high debt levels relative to their incomes [sic].”

This kind of debt is not a situation you want to be in. It is not normal to always be indebted, though it sometimes feels that way.

When budgeting, allocate a substantial monthly sum to tackle any debts you may have (e.g., student or car loans). The larger the amount, the more you will save on interest. Consider making sacrifices on other expenses to regain your financial stability.

Strategies for paying off debt

Effectively paying off debt requires a strategic and disciplined approach. Begin by listing all your debts, including balances, interest rates, and minimum payments. Focus on tackling high-interest debt by implementing the debt avalanche method. Prioritize smaller debts with the debt snowball method for motivation and momentum.

Create a realistic budget that allocates funds towards debt repayment while covering essential living expenses. Consider combining or refinancing debts to secure lower interest rates. Explore opportunities to increase your income or reduce spending to accelerate repayment.

Regularly review and adjust your debt repayment plan to ensure progress toward becoming debt-free.

Benefits of being debt-free

Achieving a debt-free status brings numerous benefits, both financially and emotionally. No debt can free you to save, invest, or pursue other financial objectives.

Being free from debt can lead to higher credit scores and improved borrowing terms. It also means less stress and greater financial security and peace of mind. This gives you more opportunities to live a fulfilling life.

4. Start saving for retirement

The earlier you begin to save for retirement, the more opportunity your money has to grow with compound interest. By investing in retirement savings, such as RRSPs and TFSAs, you can enjoy tax advantages and develop a bigger nest egg.

Importance of saving for retirement early

A strong long-term financial foundation is essential and can be achieved by saving for retirement as soon as possible. In Canada, you can invest in an RRSP or TFSA, both of which have tax benefits. When you contribute to these plans early in life, the power of compound interest helps your savings grow quickly.

Beginning to save money earlier eases the need to save larger amounts in your later years. It also provides a more sizeable fund to guarantee an enjoyable retirement.

Retirement savings options for young adults (RRSP, TFSA, etc.)

In Canada, various retirement savings options are available to help individuals prepare for their golden years. Some key options include:

- Registered Retirement Savings Plan (RRSP): A tax-advantaged account for Canadians. It allows them to contribute a percentage of their earned income each year. Contributions are tax-deductible, and investment growth is tax-deferred until withdrawal.

- Tax-Free Savings Account (TFSA): A flexible, tax-advantaged account that permits Canadians to invest in various assets with tax-free investment growth and withdrawals.

- Canada Pension Plan (CPP): A mandatory, government-administered pension plan that provides retirement income based on an individual’s lifetime contributions through employment earnings.

- Old Age Security (OAS): A government-funded pension program offering a monthly payment to eligible seniors aged 65 and older based on residency requirements.

- Employer-sponsored pension plans: Workplace pensions, such as Defined Benefit (DB) or Defined Contribution (DC) plans, where employees and employers contribute to retirement savings.

By investigating and utilizing the available options, Canadians can build a well-rounded retirement plan to ensure financial stability and comfort.

Benefits of compound interest

Compound interest is a powerful financial tool. It enables investments to grow significantly because interest is earned on both the original sum and the interest earned over time.

Taxes immensely impact investments, and a TFSA is a great way for Canadians to maximize their wealth. Investing regularly in a TFSA with interest compounding accumulates money to create larger savings. This account is great for investing in retirement.

The power of compound interest can be realized by beginning to save early and following a consistent plan. This approach will provide greater financial prosperity and security in the long run.

5. Invest in your financial education

Putting aside money can give you the autonomy to make decisions without worrying about financial limitations. This freedom could enable you to return to school. Or maybe you want to start a company. Time is short so taking some time off to travel or spend more with family is your goal.

Importance of financial literacy

It is important for young Canadians to have a strong grasp of financial matters to make smart decisions with their money. Knowledge of budgeting, saving, investing, and debt management can help you confidently manage your finances. It also helps you navigate the complexities of the Canadian financial system.

Recommended books, blogs, and courses for financial education

A wealth of resources is available to Canadians seeking to improve their financial education. Two books suggested for those seeking guidance on managing their finances in Canada include the following:

- “The Wealthy Barber” by David Chilton.

- “Personal Finance for Canadians for Dummies” by Eric Tyson and Tony Martin.

Both books provide useful and relevant tips.

Notable blogs, such as “Canadian Couch Potato” and “Millennial Revolution,” provide valuable insights on investing, budgeting, and achieving financial independence.

Organizations like the Financial Consumer Agency of Canada (FCAC) and the Canadian Securities Administrators (CSA) provide free educational opportunities. These include courses, webinars, and other resources. Canadians can access each to become more knowledgeable about financial matters.

By leveraging these resources, Canadians can enhance their financial literacy and make informed decisions for a secure financial future.

Networking with financially savvy individuals

In Canada, it is incredibly beneficial to associate with people knowledgeable about finances. Connecting with those who have the expertise or have been through similar financial situations can provide helpful guidance. They have advice and knowledge, strengthening your comprehension of financial management.

Canadians can benefit from the experience and knowledge of others to improve their financial decisions. This leads to greater financial security and prosperity.

Other ways to improve your financial standing

In addition to the above suggestions, you can set yourself up for personal, professional, and financial success by doing the following:

- Get your administration in order, including documents your parents might still hold for you.

- Ensure your taxes are accurate and up to date.

- Collect benefits that are due to you.

- Build up your credit history.

- Get insurance, even life insurance.

- Clean up your online presence.

- Surround yourself with like-minded people.

This list might sound simple. But it would surprise you how many Canadians do not have these affairs in order.

Invest in others.

There is no investment quite like the investment in others. Even if you don’t have a high income, a small donation to your favourite charity improves someone else’s life. Charitable donations are not only incredibly fulfilling, but they are also tax-deductible. “Doing the right thing” is a win-win for all involved.

Conclusion

Saving money in your twenties can be enjoyable. Seeing your emergency fund and savings account grow over time is rewarding. Not to mention your RRSP and TFSA.

Seek out other like-minded people and consult with a financial advisor. The small cost for professional advice is nothing compared to what you stand to gain with a well-rounded portfolio. Also investing in your financial knowledge is one of the best decisions you’ll ever make. As listed, many great books about personal finance are available.

Check back with Creditpicks often. Subscribe to our browser alert to read our weekly post!