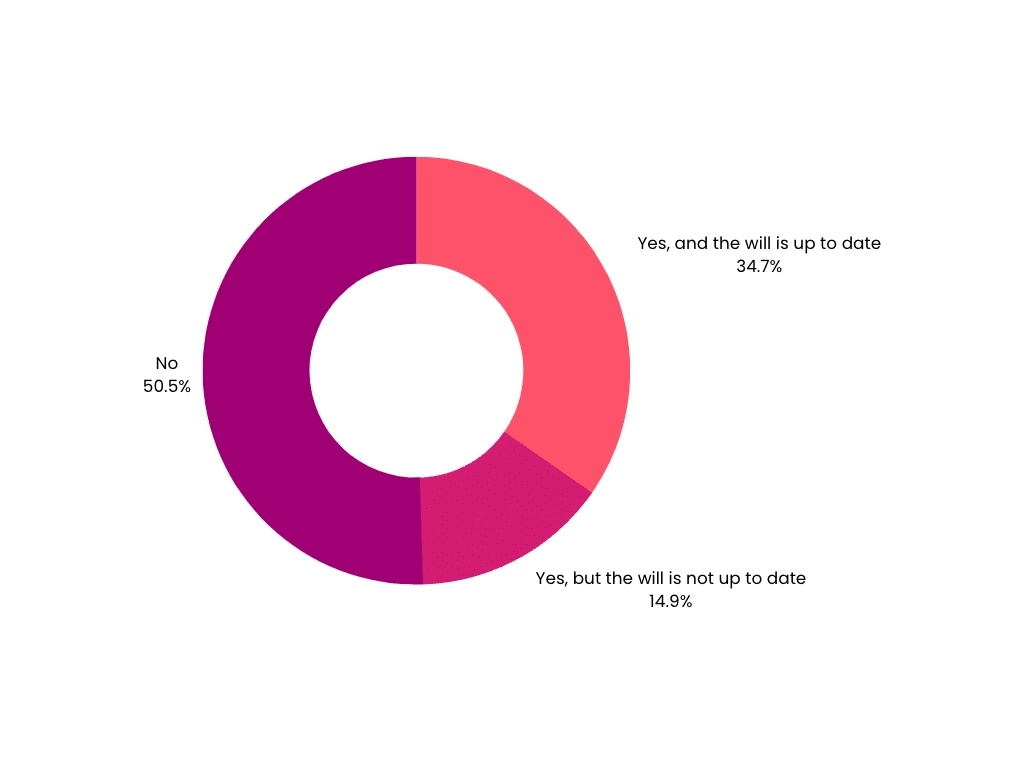

A legal will is one of the most forgotten personal finance planning requirements. It is surprising how many Canadian adults do not have a current and enforceable will. Many who do not have a will believe it is too complex and expensive or have never heard of creating a legal online will in Canada.

Epilogue is an online service changing these common misperceptions. This growing online platform makes drafting, reviewing, and executing a legal will easy. As a fully online will kit, you can create a basic will in your own home at a fraction of the traditional cost of an attorney.

Disclaimer: Epilogue does not provide legal or professional advice, such as accounting or tax advice.

Why creating a will is essential

A will is a crucial life document, like your marriage or birth certificate. This document:

- Ensures your assets are distributed according to your wishes

- Protects your loved ones from unnecessary financial and legal burdens

- Minimizes the risk of family member disputes over your estate

- Allows you to appoint guardians for your minor children

- Enables you to make charitable donations and leave a legacy

Creating a will is not just about distributing your assets; it's also about protecting your family situation and loved ones, and respecting your final wishes. Without a will, your estate may be subject to intestacy laws, potentially leading to unintended consequences and added stress for your family during an already difficult time.

Advertisements

An overview of Epilogue

Epilogue is a legal technology platform that provides the simplest and most affordable way to create an online will in Canada. Developed by legal professionals, it streamlines legal processes and helps you create, edit, and store your will and other select legal documents in one digital location. From start to finish, you can make a will in just 20 minutes using this encrypted and safe platform—without ever leaving the comfort of your home or stepping into a lawyer’s office.

Epilogue is not a document-writing company but online software that allows users to create and store documents in the cloud. In addition to Canadian legal wills, they also help with documents such as an enduring Power of Attorney for Property and Personal Care and a Social Media Will.

Founded by two former estate planning lawyers, Epilogue online wills aims to make will creation accessible and achievable to every Canadian. The process can occur anywhere there is internet connectivity since it is done online rather than in person.

Get started with Epilogue at a discounted price using code CREDITPICKS20. This code gives you $20 off your first order.

Epilogue's featured benefits

Every adult Canadian should have a will, which should be updated annually. Unfortunately, most people put off creating a will until it’s too late. With Epilogue, creating and managing estate planning documents is a breeze. What are the benefits?

- Convenience: You can create or update your will in the comfort of your home. You don’t need an attorney.

- Speed: When you build your will with Epilogue, it contains the appropriate content and is legally binding—with a perfect output in as little as 20 minutes.

- Affordability: Epilogue allows you to create a legal will in Canada with the click of a button, reducing the cost to a fraction of what you’d spend using a lawyer.

- Expertise: Two estate planning lawyers founded the company. This experience gives users confidence in the accuracy and security of the information they provide offline customers.

- Amendable: Epilogue can help you create an online will, power of attorney, and other documents you can modify or amend. In addition, you can log into their dashboard and update your records.

- Availability: As Canada’s leading online wills provider, and following all federal and provincial laws, Epilogue proudly serves the Canadian provinces of Alberta, British Columbia, Manitoba, Ontario, New Brunswick, Newfoundland & Labrador, Nova Scotia, Saskatchewan, and Prince Edward Island.

Advertisements

Eligibility for an online will in Canada

Anyone in the English-speaking provinces of Canada can use Epilogue’s platform. However, these audiences should specifically consider creating a will using Epilogue.

Business owners and entrepreneurs

If you own a business or are self-employed, having a will is crucial to ensure your company's smooth transition in the event of your passing. Your will can specify:

- Who will take over the business

- How your business and related complex assets should be distributed

- Any specific instructions for the continuation or sale of the business

Addressing these issues in your will can help protect the future of your business and the livelihoods of your employees.

Young adults

Really? Create a will in your twenties? YES! Your estate plan is essential to you and your family. All adults, regardless of age, are eligible to create an online will—even in their teenage years. Organizing and protecting your assets and property with a single will at a young age shows financial discipline.

Pet owners

In the unfortunate event of your passing, your family must know who should care for your pets. Having a will helps with planning your pet’s future and provides your family with instructions regarding your precious lifelong companions.

Couples and parents

Without question, every Couple and parent should have a legal will and power of attorney in place. With Epilogue, it is fast, simple, and inexpensive to create. Most importantly, it provides your friends and family immediate comfort from your affairs being in order. Whether you have significant assets when you pass on or need someone to care for your child, a will is the most important document you can create. Parents will also have peace of mind knowing their assets will pass to their children, immediately or in the future.

Epilogue's products

Epilogue online wills in Canada offers customers three major legal document creation options. Users can create a Will, Power of Attorney, and Social Media Will using the platform. The site walks users through a few simple questions, informing them of progress every step of the way. Upon completion, they or their family members will have a valid will and other important documents that save them from dealing with legal jargon or extraneous information.

Online will

A will is an important document outlining your estate’s administration and distribution after you die. Creating a will could mean the difference between a hassle-free distribution of your estate or additional burden and undue stress for your family. With an Epilogue online will in Canada, you can be sure your final wishes will be honoured by family and friends and the governing laws of Canada and your province.

In your will, you decide the location of your burial or cremation, service type, details about organ donations, and any other last wishes you have. Most importantly, a will determines how you disburse your assets and personal possessions. It’s a no-hassle way to plan and care for your family’s most important members.

Power of attorney

Users can create a Power of Attorney for Property or Personal Care. A Power of Attorney for Property allows you to name the person as an agent to act on your estate if you’re incapacitated. Creating, reviewing, and updating your Power of Attorney for Property is crucial, given relationships or details may change over time.

Meanwhile, a Power of Attorney for Personal Care helps name a person who can make any decisions if you cannot, such as choosing a place to live and a medical treatment method.

Combined, these two Powers of Attorney ensure your interests and family members are in good financial hands in tough times.

Social media will

Epilogue also allows you to create a Social Media Will for free. This service is for anyone who wants a specific party to manage their online presence if they pass away. Epilogue’s experts help you plan for and create a legal document that includes all your social network profiles. In addition, it provides instructions to your family members or friends regarding how to maintain or close out the profiles upon your death.

Advertisements

The will creation process with Epilogue

Creating a will with Epilogue is a straightforward process that can be completed in a few simple steps:

- Account creation: Start by creating an account on the Epilogue platform. You must provide some basic personal information and create a secure password.

- Questionnaire: Once your account is set up, you'll be guided through a series of questions about your situation, assets, and wishes for your estate. The questionnaire is designed to be easy to understand and complete.

- Review and edit: After completing the questionnaire, you can review and edit your will. Epilogue's platform will highlight potential issues or inconsistencies, allowing you to make changes as needed.

- Execution: Once satisfied with your will, you must print it out and sign it with two witnesses. Your witnesses must be adults who are not beneficiaries named in your will.

- Storage: After executing your will, store it in a safe place and inform your executor of its location. You can also store a digital copy on Epilogue's secure platform for easy access and future updates.

The cost of an Epilogue online will in Canada

The best thing about creating an online will with Epilogue is that you have a digital or printed copy at a fraction of the cost of an attorney. The platform provides a simple, affordable way to develop and memorialize a legal estate plan.

An Individual Will is $139, while a Couple’s Will costs $269. Epilogue also provides a package that includes Powers of Attorney and a Will, priced at $199 per Individual and $329 per Couple, respectively.

Wills should not be uncomfortable conversations

For most, hearing about or discussing a will is uncomfortable. This is because wills remind Canadians of their mortality. However, you should never view a will negatively. Instead, think of a will as another essential part of your overall financial plan that outlines your final wishes in written or digital form. A will takes care of the ones you love even after you are gone.

A will is a road map for your family, guiding them through a complicated time. It helps ensure your loved ones aren’t burdened with outstanding debts and that life insurance policies, bank accounts, investments, and other financial and non-financial matters are given attention. In our opinion, there is nothing better you can do for your family and friends in preparation for the unexpected.

The consequences of not having a will

While it may be uncomfortable to think about, failing to create a will can have serious consequences for your loved ones. Some of the potential risks include the following.

Intestacy laws

If you die without a will, your estate will be subject to intestacy laws, which vary by province. These laws dictate how your assets will be distributed, which may not align with your wishes.

Family disputes

With a clear plan for your estate, family members may agree on how your assets should be divided. This can lead to costly legal battles and lasting family rifts.

Unintended beneficiaries

Without a will, your assets may be distributed to unintended beneficiaries, such as estranged family members or even the government.

Guardianship issues

If you have minor children, a will allows you to designate a guardian to care for them in the event of your passing. Without a will, the courts will decide who will raise your children, which may not be your chosen person.

Delayed distribution

When there is no will, the probate process can be lengthy and complicated, delaying the distribution of your assets to your beneficiaries.

Advertisements

Intestacy Policy in Canada

As an individual, you likely own assets in several classes. These assets might include property or real estate, financial investments such as stocks and bonds, vehicles, etc. However, if something happens to you and you don’t have a will in place, or the will is invalid, the government may determine how to distribute your estate. This process could cause unnecessary strain for your loved ones during a tough time.

Prepare a legal online will in Canada with Epilogue. A properly drafted will ensure the distribution of your assets according to your wishes.

Common misconceptions about wills

Wills are often mischaracterized or portrayed in a negative context. The following are some commonly held misconceptions regarding a will.

I'm too young to need a will

Even if you're young and healthy, unexpected events can happen. Having a will ensures that your wishes are respected, regardless of age.

I don't have enough assets to warrant a will

Regardless of the size of your estate, a will helps ensure that your assets, no matter how modest, are distributed according to your wishes.

Creating a will is expensive and time-consuming

With online platforms like Epilogue, creating a will is more affordable and convenient than ever.

I can tell my family what I want

Verbal instructions are not legally binding. And, it is a bit morbid discussing your preferred funeral wishes with your surviving spouse, parent, or other family member or friend. A written, legally executed will is the best way to ensure your wishes are followed.

The realities of creating an online will

Epilogue addresses the following misconceptions. By dispelling these common misconceptions, more Canadians can understand the importance of having a will and take steps to create one.

| Misconception | Reality |

| I'm too young to need a will | Unexpected events can happen at any age. A will ensures your wishes are respected. |

| I don't have enough assets to warrant a will | Even modest estates benefit from having a will in place. |

| Creating a will is expensive and time-consuming | Online platforms like Epilogue make creating a will affordable and convenient. |

| I can just tell my family what I want | Verbal instructions are not legally binding. A written, legally executed will is essential. |

Our decision

Epilogue is the best choice for creating an online will in Canada. Besides Epilogue's featured benefits above, they are an emerging leader in this industry that is available today. Epilogue continues to help over a million Canadians easily create a legal estate plan, so they have end-of-life planning that gives them peace of mind knowing they are prepared for the future.

Creditpicks is always looking for novel ways for Canadians to enhance their financial well-being. Having a functional legal will or power of attorney documents are just a couple ways of doing that. Subscribe to our site for free access to the Your Personal Finance Guide 2024-2025 e-book, and more helpful money tips delivered directly to your inbox!

Advertisements