Joining a Savings Challenge can be a fun and effective way to save money and reach your financial goals. By committing to a savings plan, you'll be more likely to stick to it and make progress towards your objectives.

Whether you're looking to build an emergency fund, pay off debt, or save for a big purchase, a Savings Challenge can help you get there. We'll explore the benefits of participating in a Savings Challenge and provide you with the tools you need to succeed.

Key Concepts

- Understand the concept of a Savings Challenge and its benefits

- Learn how to create a savings plan that works for you

- Discover strategies to stay motivated and on track

- Explore different types of Savings Challenges to suit your needs

- Achieve your financial goals with a Savings Challenge

What Are Savings Challenges and Why They Matter

Savings challenges are a way to save money in a structured way. They help people develop good financial habits and reach their saving goals. These challenges often have a fun twist to keep things interesting.

The Psychology Behind Effective Saving

Savings challenges work by tapping into our natural behaviors. They make saving automatic and less likely to be forgotten. By committing to save, people can avoid procrastination and impulsive spending.

Understanding our emotional connection to money is key to saving. Savings challenges help build a healthier financial mindset. They turn saving into a regular habit.

How Challenges Transform Financial Habits

Savings challenges change how we handle money by creating a plan. They teach people to save first and manage their spending better.

The Power of Gamification in Finance

Gamification is a big part of why savings challenges work. They add competition, rewards, and achievements to save money. This makes saving fun and keeps people motivated.

By making saving fun, challenges help build lasting financial habits. They turn a boring task into something enjoyable and rewarding.

The Benefits of Joining a Savings Challenge

Starting a savings challenge is more than saving money. It's about changing your financial future. By joining, you work towards your financial goals and learn habits that last.

Financial Advantages Beyond Just Saving Money

A savings challenge gives you a clear savings plan. It helps you manage your money better. You learn to spend wisely and make smart financial choices.

| Financial Benefit | Description |

|---|---|

| Reduced Impulse Spending | With a savings goal, you avoid buying things on a whim. |

| Increased Savings | It builds a savings habit, making you more financially secure. |

| Improved Financial Literacy | You understand your finances better and learn to manage them. |

Psychological Benefits and Mindset Shifts

Being part of a savings challenge has big mental benefits. It makes you feel accountable and keeps you on track with your financial plan.

How Challenges Create Accountability

Savings challenges make you commit. Sharing your goals or tracking your progress keeps you focused on your financial goals.

Building Sustainable Money Habits for Life

Most importantly, a savings challenge teaches you to manage money well. Consistent saving and financial management lay a strong foundation for your future.

Popular Savings Challenge Models to Consider

Starting a savings journey can be fun and effective with the right savings challenge. These challenges offer structured ways to save money. They help you build good financial habits.

The 52-Week Money Challenge Explained

The 52-week money challenge is a well-known savings plan. You save an amount equal to the week number. For example, in week 1, you save $1, and in week 52, you save $52.

This challenge helps you save regularly. It can lead to saving over $1,300 in a year.

No-Spend Challenges: Weekly, Monthly, or Categorical

No-spend challenges mean avoiding unnecessary purchases for a set time. This can be a week, a month, or a specific category like dining out. These challenges help you find ways to save by cutting back.

The 100 Envelope Challenge Method

The 100 envelope challenge involves labeling 100 envelopes with numbers from 1 to 100. You fill them with corresponding amounts. Then, you randomly pick an envelope and save the amount inside.

This challenge can help you save up to $5,050 in 100 days.

The $5 Bill Challenge and Other Cash-Based Approaches

Cash-based savings challenges, like the $5 bill challenge, involve saving cash. For example, you save every $5 bill you get as change. This method is simple but might not work for those who use digital payments.

Digital Alternatives for Cash-Free Households

For those who prefer digital payments, there are digital savings options. You can set up automatic transfers to a savings account. Or, use digital savings apps that round up your purchases to the nearest dollar or a set amount.

| Savings Challenge | Description | Potential Savings |

|---|---|---|

| 52-Week Money Challenge | Save an amount equal to the week number | $1,378 |

| 100 Envelope Challenge | Save random amounts from $1 to $100 | $5,050 |

| $5 Bill Challenge | Save every $5 bill received | Variable |

Exploring these savings challenge models can help you find the best fit for your financial goals. This makes your savings journey more engaging and effective.

How to Select the Perfect Savings Challenge for Your Situation

Finding the right savings challenge is key to a successful plan. We need to look at our financial situation, match challenges to our goals, and think about our personality and how we get motivated.

Assessing Your Current Financial Reality

Before choosing a savings challenge, we must know our financial status. We should calculate our income, expenses, debts, and savings. This helps us figure out how much we can save.

Matching Challenges to Your Specific Financial Goals

There are different savings challenges for different goals. For example, a short-term challenge might be best for saving for a vacation. But, a long-term challenge is better for saving for retirement.

Considering Your Personality and Motivation Style

Our personality and how we get motivated are important in picking a challenge. Some people like to compete, while others prefer a calm approach.

When to Choose Short vs. Long-Term Challenges

Choosing between short and long-term challenges depends on our goals and what we prefer. Short-term challenges give quick motivation. Long-term challenges help us save regularly over time.

| Challenge Type | Duration | Best For |

|---|---|---|

| Short-term | Less than 3 months | Quick savings goals, building initial momentum |

| Long-term | 6 months to 1 year or more | Sustained savings habits, long-term financial goals |

Setting Up Your Savings Challenge for Maximum Success

Starting a savings challenge is more than just wanting to save. It needs a smart plan. You must set clear goals, realistic timelines, and strong support systems.

Creating SMART Financial Goals

First, make SMART financial goals. This means setting specific, measurable, achievable, relevant, and time-bound targets. For example, “I want to save $10,000 in 12 months for a house down payment” is a SMART goal.

Establishing Realistic Timelines and Milestones

Break down big goals into smaller, doable steps. This makes the task easier and gives you a feeling of success as you hit each milestone. For saving $10,000 in a year, aim for $833.33 monthly or $192.31 weekly.

Building in Accountability and Support Systems

A support system boosts your savings discipline. This could be a savings buddy, a financial advisor, or online savings groups.

Preparing for Possible Obstacles

Think about what might get in your way, like unexpected bills or low income. Having backup plans, like an emergency fund or cutting spending, keeps you on track.

Essential Tools and Resources for Your Savings Challenge

To succeed in your savings challenge, you need the right tools and resources. A good plan can help you reach your financial goals faster.

Top Savings Apps and Digital Tracking Tools

Using the right savings apps can make saving easier. Apps like Wealthic and YNAB help with automated savings and tracking expenses. They give you updates and insights into your spending.

| App Name | Key Features | Platform |

|---|---|---|

| Wealthica | Budgeting, investments, saving | iOS, Android |

| YNAB | Budgeting, expense tracking, financial planning | iOS, Android |

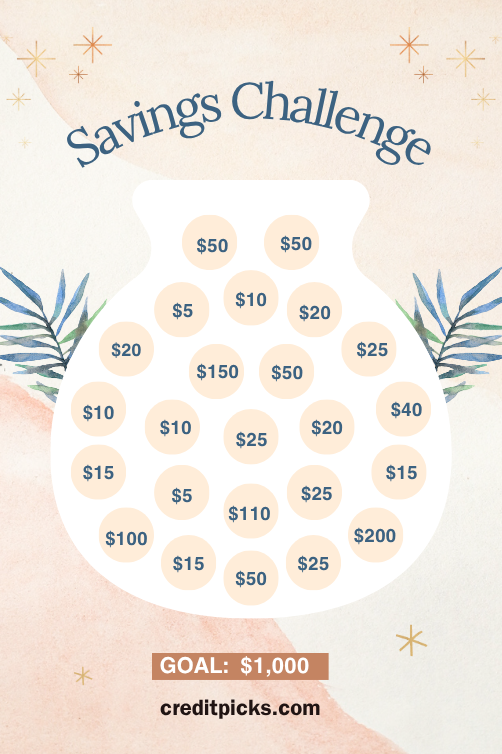

Printable Worksheets and Visual Progress Trackers

If you like a hands-on approach, try printable worksheets and visual trackers. They let you track your progress in a real way. This can make you feel a sense of achievement as you hit savings goals.

Visual progress trackers are great because they show your progress clearly. They can really motivate you.

Finding Community Support Groups and Accountability Partners

Being part of a community or having an accountability partner can boost your savings challenge. Online forums, social media groups, and local groups offer a place to share and get support. They help you stay motivated.

“The way to get started is to quit talking and begin doing.”

Walt Disney

Automating Your Savings Process

Automating your savings makes it easier and less likely you'll forget to save. Set up automatic transfers from your checking to savings or investments. This way, you'll keep moving toward your financial goals without effort.

Overcoming Common Obstacles During Your Savings Challenge

Starting a savings challenge can change your life, but it comes with challenges. Knowing how to beat common obstacles is key to success.

Strategies for Handling Unexpected Expenses

Life is full of surprises, and they can hurt your savings. To fight this, start an emergency fund. Put a little of your savings into it to protect against future shocks.

Techniques for Maintaining Long-Term Motivation

Staying motivated is vital to win a savings challenge. Set reachable goals and celebrate your wins. This keeps you excited and focused on your goal.

When and How to Adjust Your Challenge Parameters

At times, you might need to tweak your savings plan. If your challenge is too hard or too easy, rethink your goals. Make changes to fit your financial life better.

Dealing with Social Pressure and FOMO

Social pressure and FOMO can slow you down. Keep your eyes on your savings goals and remember why you started. Being around people who share your goals can also help you stay on track.

| Obstacle | Strategy |

|---|---|

| Unexpected Expenses | Build an emergency fund |

| Maintaining Motivation | Set clear milestones and celebrate progress |

| Social Pressure/FOMO | Focus on financial goals and seek support |

Effective Methods for Tracking Your Savings Challenge Progress

To reach your savings goals, it's key to keep an eye on your progress. Tracking your savings challenge helps you stay on track and make changes when needed.

Digital vs. Physical Tracking Systems

There are two main ways to track your savings: digital and physical systems. Digital tools, like savings apps, are easy to use and update automatically. Physical methods, like savings journals, offer a hands-on experience that some find more engaging.

Meaningful Ways to Celebrate Milestones

Celebrating your achievements is vital to keep you motivated. You can reward yourself with something small or share your success with loved ones. Remember,

“Success is not final, failure is not fatal: It is the courage to continue that counts.”

– Winston Churchill.

Learning and Adapting from Setbacks

Setbacks happen, but they shouldn't stop you. Use them as chances to learn and improve. Find out why you hit a snag and tweak your plan.

Visualizing Progress for Increased Motivation

Seeing your progress can really motivate you. Make a chart or graph to track your savings. It shows how far you've come and keeps you going.

Using these strategies will help you track your savings better and reach your financial targets.

Customizing Savings Challenges to Fit Your Unique Life

To make the most of a savings challenge, it's key to make it fit your life. Customizing it helps you reach your financial goals, no matter your income or life situation. This makes the challenge more effective and easier to stick with.

Adapting Popular Challenges to Different Income Levels

Popular savings challenges can be changed to fit any income. If you're on a tight budget, start with a smaller challenge that gets harder over time. If you earn more, try to save a bigger part of your income.

- For lower incomes: Try challenges that ask you to save small amounts often.

- For higher incomes: Aim to save a big percentage of your income or focus on specific goals.

Creating Your Own Personalized Challenge Framework

To create a personalized savings challenge, first figure out your financial goals. Then, look at your income and expenses to set a realistic savings goal. This way, your challenge will be both tough and doable.

Seasonal and Life Situation Adjustments

Life changes with the seasons and unexpected events happen. Adjusting your savings challenge to these changes helps you stay on track. For example, save more when you earn more or adjust spending during holidays.

Family and Group Challenge Modifications

Getting family or friends involved in your savings challenge adds accountability and support. You can work together towards a savings goal or compete to see who saves the most. This makes the challenge more fun and engaging.

Inspiring Success Stories from Real Savings Challenge Participants

Many people have saved a lot by joining savings challenges. These challenges not only help them save money. They also teach them to manage their finances better.

How Small Daily Changes Led to Significant Financial Wins

Small daily changes were key for many. They started saving a little each day. Over time, this added up to a lot of money.

Transformative Financial Journeys and Life Changes

Savings challenges do more than just save money. They also lead to big life changes. People feel less stressed and more confident about their money choices.

Key Lessons from Successful Challenge Completers

Those who succeed share important lessons. They say being consistent and patient is key to reaching financial goals.

How Challenges Changed Their Relationship with Money

These challenges also change how people view money. They help develop better spending habits and a more mindful approach to money.

| Savings Challenge | Average Savings | Participant Feedback |

|---|---|---|

| 52-Week Money Challenge | $1,378 | “This challenge helped me develop a savings habit.” |

| No-Spend Challenge | $942 | “It made me more mindful of my spending.” |

| 100 Envelope Challenge | $5,050 | “I was surprised by how much I could save.” |

Conclusion: Taking the First Step in Your Savings Challenge Journey

Savings Challenges are a great way to reach your financial goals. They help you build good money habits and save more. This can lead to big steps forward in your financial life.

It's time to start your Savings Challenge today. You can pick a well-known challenge or make your own plan. The important thing is to begin and keep going. With the right attitude and support, you can beat any financial hurdles and succeed.

When you join a Savings Challenge, you're doing more than saving money. You're investing in your future. Stay committed and you'll reach your goals. This will bring you financial peace and stability.