Like many countries, Canada is experiencing a higher inflation rate. Inflation causes a rapid rise in the overall cost of products, services, and living expenses. Consequently, people are left with little to no money and sometimes even a shortfall at the end of each month. With this national challenge, we must learn the best ways to save money in Canada.

Though inflation is alarming, there are ways you can get a hold of your finances and save a bit—or a lot—each month. Then, armed with knowledge and an unwavering commitment to saving, you can start looking forward to a richer tomorrow. Continue reading below for fast, practical, and easy-to-apply money-saving tips.

Separate Your Expenses from Savings

The first and most crucial step is making a list of your monthly expenses, including your needs and wants. Then, you can label these as fixed and variable expenses. You must pay fixed expenses to survive, including your rent or mortgage, utility bills, car insurance, and a set groceries budget. Variable expenses are everything else, such as going to the movies, nights out with friends, or even the gas you put in your car for purposes other than work.

When you have a detailed picture of how much you spend each month, line it up next to your income. This exercise will help you quickly determine where to cut monthly costs and allocate more money to savings.

Suppose your financial picture shows you have a shortfall in income each month. Unfortunately, this situation leaves you with no opportunity to save. In that case, we recommend you revisit your list and cut as many variable expenses as possible. It’s going to be tough reining in your expenses as we all love our little luxuries—whatever they may be.

Once you’ve cut your expenses enough to leave you with savings at the end of the month, create a list of your monthly savings goals. Your list can include categories such as a down payment for a home, education for a more marketable job, retirement, etc. Set goals for one or more of these categories and break them down into monthly savings goals.

Example: If you intend to purchase a home in the next five years and need a $40,000 down payment, break the total into monthly savings milestones to create an achievable goal.

$40,000 ÷ 60 (months in five years) = $667.00/month

To reach your 5-year goal of $40,000, you need to set aside $667.00 monthly.

In short, if you separate your expenses from your savings, you can easily break down the best way to budget savings for a specific goal. This is one of the best ways to save money in Canada.

Automate Transfers: Pay Yourself First

If you’re finding it difficult to commit to saving money because of spending temptations, we recommend you automate your savings. Doing this is as easy as signing into your online banking and scheduling recurring automated transfers from your chequing account to your savings account each payday. By doing this, you will accumulate savings over time, making it easier to save and plan for vacations, college tuition, or an emergency fund.

Think about it. If you automate just $100 into a secured savings account each payday, you can save $2,600 in 12 months, assuming you get paid bi-weekly. That’s a whopping $13,000 over five years from setting up automated transfers.

Remember that many Canadians fail to save because it’s easy to spend idle money sitting in your chequing account. As such, setting up automatic transfers makes accessing those funds a bit more complicated, hopefully reminding you of your savings goals.

Take Advantage of Employer RRSP Matching

If your employer offers to match your RRSP contributions dollar to dollar, or even fifty cents for every dollar, take them up on this generous offer. RRSP matching is free money to incentivize you to save for your retirement. If you’re signing on with a new employer and have never contributed to RRSPs, consider this the right time to start saving for retirement—no matter your age.

According to a Canadian Institute of Actuaries survey, nearly half of non-retired Canadians don’t think or are unsure they will be able to live comfortably during retirement. Whether this national plight is due to stagnant wages coupled with an ever-rising cost of living, financial illiteracy, or a combination of both, RRSPs are an excellent way to avoid this dilemma. So start taking advantage of free money anywhere you can, including employer matching.

Signup for a Side Hustle

The idea of establishing savings, investing, travel, and homeownership is becoming less attainable for the average Canadian, thanks to the rising costs of everything! But if you ask us, there are ways around this bleak reality if you take proper measures—namely, a lucrative side hustle. One of the best ways to save money in Canada is to earn more. There is no shame in working multiple gigs to determine your secure financial future.

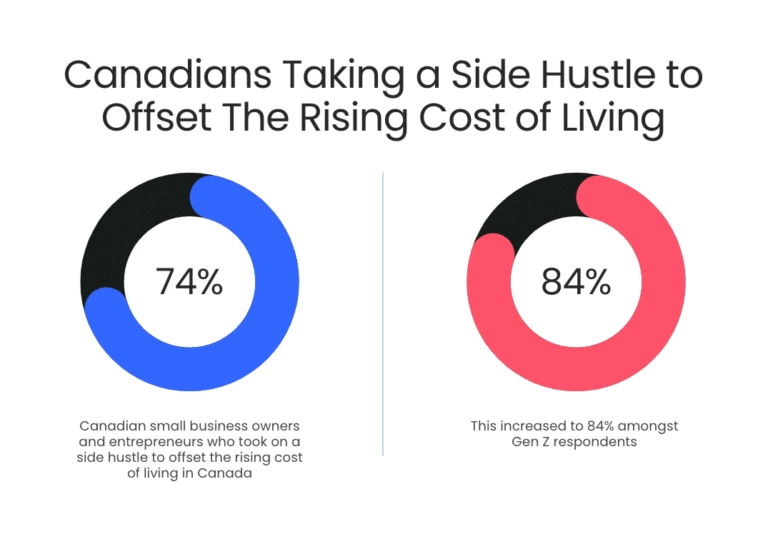

According to the Small Business survey, an impressive 74% of Canadian small business owners or aspiring entrepreneurs are considering taking on a side hustle or another small business to get ahead of the rising cost of living. Gen Z responses were even higher!

Saving is about finding the strategy that works best for you. With the right tools and understanding of your finances, we believe saving more money is possible and easy. We hope you enjoyed our post and subscribe to our blog for more great money, credit, and debt tips!

Here are some of the more popular and emerging side hustles popping up around Canada:

- Dog walking (Rover, Spot Dog Walkers)

- Food delivery (Door Dash, Skip the Dishes)

- Delivering groceries (Instacart)

- Uber or Lyft driver

- Freelancer (writing, editing, proofreading, virtual assistant)

- Online tutoring

- And many more!

If you can spend even a few extra hours per week in a side hustle that nets you a few hundred dollars, you can use these funds to build a savings account. In addition, your side gig will provide income that would otherwise be nonexistent by working just your day job.

Use Government Regulated Tax Shelters

Every Canadian can reduce or defer their annual income tax. This reduction is achieved by contributing to a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA). We recommend doing this as it reduces your taxable income for the year. As well, this reduction means you will receive a larger return when you file your annual income taxes. This lump sum payment can kickstart a savings account or add to an existing and growing one.

Contributing to a tax deferral account allows you to kill two birds with one stone. One is preparing for a significant tax return, which can be used for savings. And two, in contributing to your retirement fund.

We recommend everyone take advantage of these legal tax shelters. They allow Canadians to get ahead of achieving their future financial freedom. This is probably one of the best ways to save money in Canada.

Pay Down Your Credit Cards

After covering your fixed monthly bills, you may have high monthly credit card payments. And you’re probably not left with much for savings. The sooner you pay down your credit cards, the sooner you can begin saving money. The best approach is to tackle high-interest cards first. These cards and their interest account for the most significant portion of your payments—eating up potential savings.

Example: Let’s say you have a credit card with a 22% interest rate (APR). You also have an active savings account paying 3%. This gives you a sense of the waste of credit card interest and the gain of savings accounts.

Here are a few tips you can try to pay down high-interest and high-balance credit cards:

- Transferer the balance to an interest-free or low-interest credit card. Interest-free cards are usually promotional and typically only last one year. So paying down the balance in the prescribed timeframe is essential for this action to be worthwhile.

- If you have a nest egg, put a bit toward high-interest debt. Then you can resume saving. But don’t let your savings account drop to a zero balance.

If credit card debt is the only thing preventing you from saving, cut spending and couple that with our tips. Your proactiveness will put you in an excellent position to pay down your debt, save some money, and enhance your financial well-being.

Become Investing Savvy

If you are a Canadian already saving money, but your balance doesn’t seem to grow because you can only put aside a small amount each month, we recommend investing those funds to take advantage of compounded interest.

If you’re new to investing, rest assured there are strategies specifically for risk-averse investors (yielding minimal risk). So you don’t need to worry much about losing your money if the market crashes. These potential investments include the following:

- Mutual Funds

- ETFs (Exchange-Traded Funds)

You can set up a Mutual Fund and ETF portfolio by visiting a personal banker or signing up with an online service such as Wealth Simple. The best thing about investing in these types of multi-company portfolios is that if one or more of the companies in the portfolio dips in value, your money generally remains safe trading off the value of the other companies. As a result, when you put your money to work rather than sitting in a low-interest savings account, your wealth will grow faster. And your money will maintain more value than not when inflation spikes.

Bottom Line

This post should have given you the basics on the best ways to save money in Canada. At Creditpicks, our goal is to provide you with the information you need to be successful with your finances and help put you in your best financial position.

Saving is about finding the strategy that works best for you. With the right tools and understanding of your finances, we believe saving more money is possible and easy. We hope you enjoyed our post and subscribe to our blog for more great money, credit, and debt tips!