The shift towards online investing has become increasingly pronounced. With a keen focus on optimizing investment strategies through accessible and efficient platforms, CIBC Investor’s Edge is a leading choice for Canadians. This platform offers highly competitive fees and cutting-edge tools designed to cater to seasoned and emerging investors.

When investing online, understanding the nuances of platforms like CIBC Investor’s Edge becomes essential for anyone looking to navigate the financial markets effectively.

Understanding CIBC Investor’s Edge

As a Big Five Canadian bank at the core of financial innovation, CIBC Investor’s Edge demonstrates digital investment solutions' power. Operated by CIBC Investor Services Inc., this platform benefits from the robust backing of the Canadian Imperial Bank of Commerce (CIBC), ensuring a secure and trustworthy environment for investors.

The transition from traditional portfolio management to online platforms is simplified through CIBC Investor’s Edge. It offers a seamless user experience without the need for extensive expertise in finance.

Advertisements

Quick look: Pros and cons

The following table is a quick look at the pros and cons of CIBC’s Investor’s Edge:

| Pros | Cons |

| Numerous free investing tools, webinars, educational resources, and more | The low trading account fees of the platform are still higher than many other discount trading platforms |

| A subsidiary of CIBC, a reputable Canadian bank | No free ETF trades |

| A wide variety of investments and account types | $100 fee for inactive accounts that do not hold the minimum required amount (TFSA and RESP have no activity requirements) |

| Lower trading fees than the other big bank online trading platforms | |

| Discounts for students and active traders | |

| No minimum investment required |

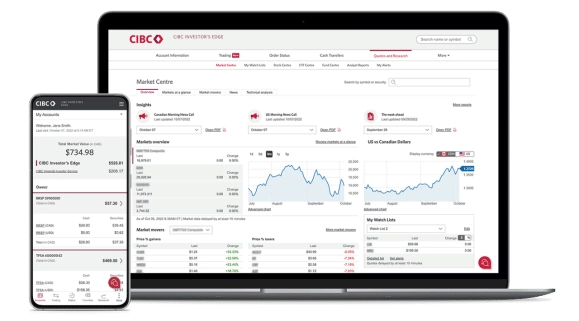

Initial user experience and dashboard navigation

The CIBC Investor’s Edge platform is intuitively designed to guide users through personalized investment decision-making processes. With its complementary mobile app, investors are granted the flexibility to manage their portfolios on the go, ensuring that investment opportunities are never missed.

The platform's commitment to accessibility is furthered through its competitive fee structure and valuable resources for beginners, making investment more approachable than ever.

Navigating the Canadian financial landscape with CIBC Investor’s Edge

Online Investing in dynamic financial markets requires a platform that not only offers a broad range of investment options but also understands the unique needs of Canadian investors. CIBC Investor’s Edge offers a tailored experience that aligns with Canada's regulatory environment and market opportunities. Here's how it caters specifically to Canadians:

- Canadian market insights: Access to comprehensive market reports and insights focused on Canadian stocks, ETFs, and economic indicators, helping investors make informed decisions based on local market conditions.

- Currency flexibility: With accounts that can hold both CAD and USD, investors can seamlessly manage investments in both Canadian and international markets without incurring currency conversion fees on each transaction.

- Tax efficiency: Tools and resources designed to maximize tax efficiency, particularly around TFSA and RRSP accounts, ensuring Canadians can leverage these accounts for tax-advantaged growth and retirement savings.

This focus on the Canadian financial landscape ensures that CIBC Investor’s Edge investors are well-equipped to navigate the complexities of investing in Canada and beyond.

Advertisements

Investment offerings and account types

CIBC Investor’s Edge provides a wide range of investment products, enabling investors to diversify their portfolios.

Creditpicks

Tweet

CIBC Investor’s Edge provides a comprehensive array of account options catering to a wide range of financial needs. The platform accommodates various investment objectives, from Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) to corporate and non-personal accounts.

Furthermore, investors can access an extensive selection of financial products, including stocks, exchange-traded funds (ETFs), and mutual funds, facilitating a diversified investment approach.

Detailed overview of account types

CIBC Investor’s Edge caters to a range of investment needs through its extensive offering of account types. Below is a table summarizing the key features of each account type, aiding investors in making informed decisions.

| Account type | Description | Ideal for |

| TFSA | Allows earnings to grow tax-free; withdrawals can be made any time, free of tax | Investors seeking tax-efficient growth |

| First Home Savings Account (FHSA) | Allows new homebuyers the opportunity to save a down payment in a tax-free environment | Individuals or couples looking to buy their first home |

| RRSP | Offers tax-deductible contributions and tax-deferred growth, ideal for retirement savings | Individuals planning for retirement |

| Locked-in Retirement Account (LIRA) | A locked-in version of an RRSP for holding pension funds, with withdrawals typically restricted until retirement | Individuals with pension funds needing a tax-deferred growth environment |

| Registered Retirement Income Fund (RRIF) | Converts retirement savings into regular income streams, with minimum withdrawal requirements | Retirees needing regular income |

| Registered Education Savings Plan (RESP) | Supports post-secondary education funding, with tax-deferred growth and access to government grants | Parents planning for their child’s education |

Investment products

CIBC Investor’s Edge provides a wide range of investment products, enabling investors to diversify their portfolios. Here are the key offerings:

- Stocks: Buy shares in companies globally across various sectors.

- Exchange-traded Funds (ETFs): Invest in a diversified portfolio of assets with the flexibility of stock trading.

- Mutual funds: Pool your money with other investors to purchase a portfolio of stocks or bonds managed by professional fund managers.

- Options: A contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a certain date.

- Guaranteed Investment Certificates (GICs): Secure your investment with a fixed interest rate over a predetermined period.

- Fixed income: Includes bonds and other debt instruments offering regular income, ideal for risk-averse investors.

Advertisements

Fees

CIBC Investor’s Edge offers some of the lowest trading fees among the big five banks in Canada. The investors active on CIBC’s trading platform are in four primary categories that include following:

Regular investor

You can buy Canadian and U.S. securities, including stocks, ETFs, and others, for a flat fee of $6.95 per online trade. Options will also cost you $6.95 per online trade plus $1.25 per contract.

Young investor

The most exciting offer is that young investors between 18 and 24 can trade stocks and ETFs online for free. This is for both Canadian and U.S. stock trades. They have also waived the fee for annual account maintenance to make the platform even more attractive to young investors.

Student investor

The good news for students is that CIBC’s online brokerage offers them a discounted price of $5.95 per online trade. However, they should have a CIBC Smart™ Account to qualify for this offer.

Active investor

The next good offer is for those traders who make 150 or more trades per quarter. Under Active Trader Pricing, this discount is helpful for those who regularly trade and are eligible for the discounted rate. The fee for active traders is as low as $4.95 per online trade. It is $4.95 plus $1.25 per contract when trading in options.

Cash and margin rates

In the case of non-registered accounts, the margin rate will change based on the current interest rate. For example, the debit balance rates are 8% and 8.75% for CAD and USD accounts, respectively. Also, the rate charged for debit balances for registered accounts is 9% and 9.75% for CAD and USD accounts, respectively.

Telephone trading fees

You can also place a trade by phone, but CIBC Investor’s Edge will charge you a minimum commission fee of $50 in such a case for all Canadian and U.S. orders.

No Account Fees

No minimum account balance or trades are required with CIBC’s online trading platform; however, you will be charged an annual fee of $100 if your non-registered account holds $10,000 or less.

Regarding registered accounts, there is an annual fee of $100 if your account holds $25,000 or less, though the fee is not required for TFSA or RESP accounts.

Platform features and mobile application

Highlighting its feature-rich platform, CIBC Investor’s Edge offers tools such as customizable watch lists, professional charting options, and insightful market reports. These resources are designed to empower investors with the knowledge to make informed decisions.

The mobile app, frequently updated for optimal performance, extends the functionality of the desktop platform, offering a comprehensive investment experience that is both efficient and user-friendly.

An in-depth look at platform features

CIBC Investor’s Edge goes beyond basic trading to offer advanced features for an enhanced investment experience. Here’s a closer look:

- Watch lists: Customize up to 20 to closely monitor potential investment opportunities.

- Charts: Access professional charting tools with over 100 indicators, enabling detailed market analysis.

- Market reports and alerts: Stay informed with daily market reports and set up alerts for price changes or news that could impact your investments.

- Educational resources: Benefit from a wealth of knowledge through webinars, tutorials, and articles tailored to investors at all levels.

Mobile app features

The CIBC Mobile Wealth app enhances the online investing experience with features like:

- Trade execution: Buy and sell stocks, ETFs, and other securities directly from your device.

- Portfolio monitoring: Track your investments’ performance, view balances, and analyze gains or losses.

- Customizable charts: Use the app’s charting functions to visualize stock performance and market trends.

- Secure access: Log in with biometric authentication for secure and convenient access to your account.

- Document access: On the go, view and manage your financial documents, including trade confirmations and account statements.

Advertisements

Customer service and support

Backed by the reputable infrastructure of CIBC, Investor’s Edge provides exceptional customer service, accessible via phone, email, and online chat. This support is crucial for investors seeking guidance or encountering issues, ensuring a smooth and responsive investment journey.

Commitment to Canadian investors: Customer support and community engagement

CIBC Investor’s Edge not only provides a robust online investing platform but also places a strong emphasis on customer support and engagement within the Canadian investing community. This commitment is reflected in the following ways:

- Comprehensive customer support: Offering dedicated support through various channels, including phone, email, and live chat, CIBC Investor’s Edge ensures Canadian investors can access timely assistance. This includes support in Canada's official languages, English and French, catering to a diverse client base.

- Educational initiatives: Through webinars, online tutorials, and educational resources, CIBC Investor’s Edge empowers Canadians with the knowledge to make informed investment decisions. Topics range from basic investing principles to advanced strategies, focusing on Canadian financial instruments and market trends.

- Community engagement: Active participation in community events and partnerships with Canadian educational institutions to promote financial literacy among Canadians of all ages. This engagement helps build a more informed and savvier investor base, contributing to the overall health of Canada’s financial ecosystem.

By focusing on personalized support and education, CIBC Investor’s Edge demonstrates its commitment to fostering a strong and informed community of Canadian investors, reinforcing its position as a leading platform for online investing in Canada.

A natural investment platform solution

CIBC Investor’s Edge represents a pivotal development in online investing for Canadians. Its blend of competitive fees, diverse investment options, and robust customer support makes it an attractive choice for individuals looking to tailor their investment strategies in 2024. For those ready to embark on or enhance their online investing journey, CIBC Investor’s Edge offers a solid foundation to achieve financial goals.

Explore the possibilities with CIBC Investor’s Edge and take control of your financial future. Whether you're a seasoned investor or just starting, this platform provides the tools and resources to navigate the financial markets confidently. Visit CIBC Investor’s Edge today to learn more and begin your investing journey.

Looking for a new personal or business credit card?

Creditpicks recently posted a comprehensive article about American Express’s Platinum Card® and Business Edge™ cards. Apply for either card today and enjoy enhanced bonus points, high credit limits (including no pre-set spending limit), and flexible payment options. Read more about these American Express cards today!

Advertisements