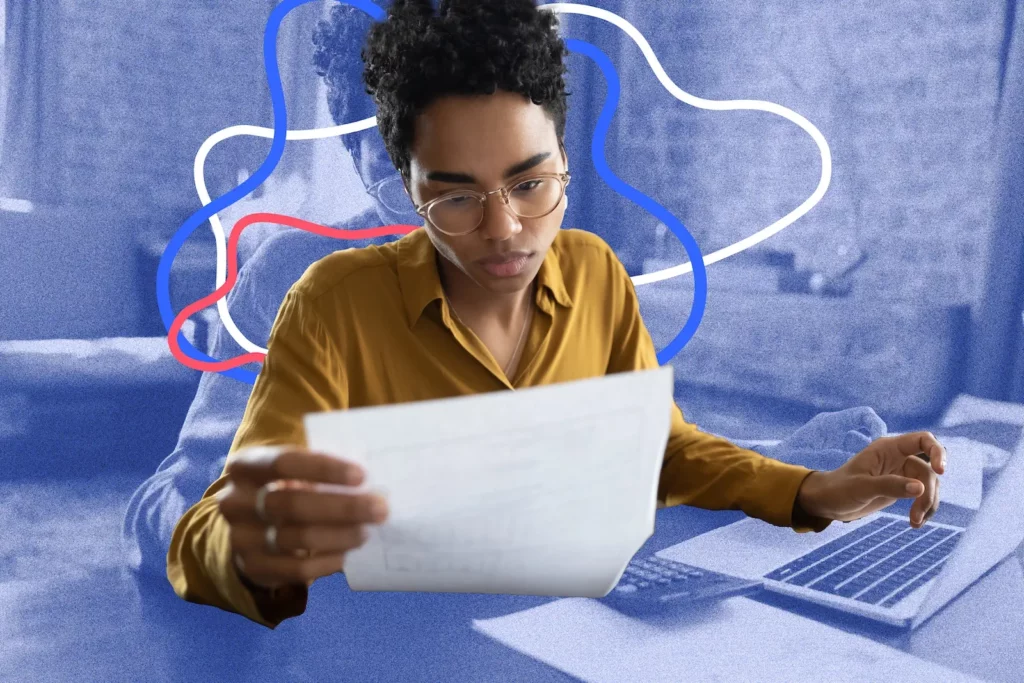

Inflation rates in Canada reached a 39-year high in 2022. How does high inflation in Canada affect consumers, businesses, and investors?

COVID-19 caused mayhem throughout economies around the globe. In June 2022, Canada’s inflation rose to 8.1%! Even though inflation has fallen to 6.9% as of October 2022, inflation rates in Canada impact everyone in various ways. And it is even more critical to understand how these rates will directly affect you.

Before you decide on the best investments in times of high inflation, let’s start with the basics and how it influences our lives.

What is Inflation?

In general, inflation is the rate that prices for goods and services rise. Inflation helps measure how price levels in an economy change over time.

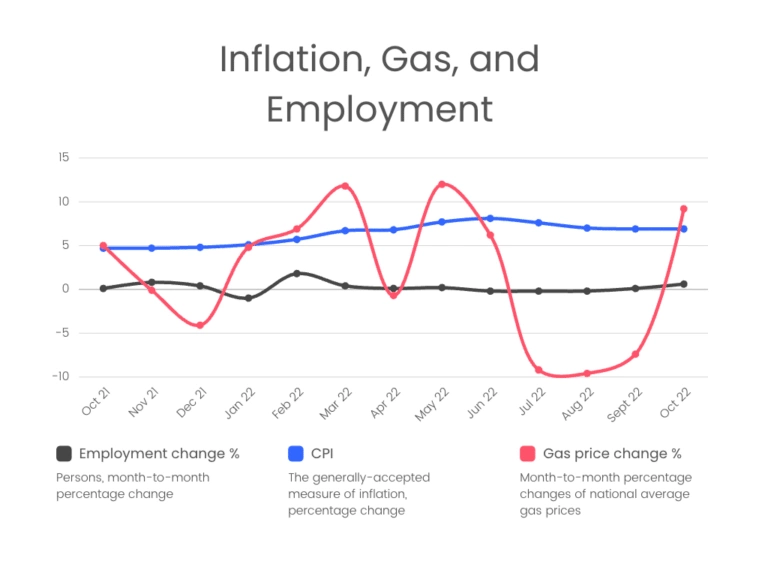

When inflation rises, consumer buying power decreases. Gas is one of many products affected by inflation. Gas prices in June 2022 were approximately $1.89 per litre. At the time of writing, mid-December 2022, gas prices are $1.24 per litre. That $0.65 is a 34% difference in how much (less) gas you’re getting at these two points.

John Maynard Keynes, a 20th-century British economist, once defined inflation as “the invisible tax.” Whenever a government prints more money to cover its current debts, the value of the currency decreases and inflation, conversely, rises. As such, governments benefit from an increase in tax revenue while their population and businesses suffer.

There is also Deflation

As you might guess, deflation is the exact opposite of inflation. The prices of goods and services decrease over time. Consumer purchasing power increases. Deflation means you can buy more products and services for the same amount. Though this may sound like a dream, it is not necessarily indicative of a healthy economy. Extended periods of deflation can signal economic downtown, recession, and even potential depression.

You’ve probably heard the Aesop quote, “It is possible to have too much of a good thing.” This truth stands even in economics. When inflation is too high or too low, economies suffer. Maintaining a balance between the two is the key to a healthy economy.

What is Considered High Inflation in Canada?

It is important to note that inflation must rise steadily and predictably for an economy to maintain its smooth functioning and be considered healthy. On the other hand, if inflation is too high or too low, various problems arise. The ideal inflation rate in Canada is between 1% and 3%.

When inflation is too high, the prices of goods outpace income levels. As a result, items such as household items and groceries become far less affordable, and consumers struggle to maintain their same standard of living, all things alike.

The Government of Canada and the Bank of Canada work together to maintain low and predictable inflation rates. In 1991, an agreement was made to keep the target level of inflation at two percent. If this level was held, a meal that cost you $10.00 this year should cost you $10.20 next year. And if your salary was adjusted solely to align with inflation rates, your $60,000 annual salary this year should increase to $61,200 next year.

Though the Bank of Canada has typically maintained the two percent standard, the pandemic has sent our economy into unprecedented times. So recently, the Bank of Canada increased the prime interest to 6.45% to combat high inflation levels.

Is Inflation High in Canada Right Now?

Canada is currently in a period of high inflation because of the COVID-19 pandemic. The Bank of Canada’s recent announcement to raise the policy rate by three-quarter points is part of a plan to help tackle high inflation resulting from unprecedented economic influences.

Like many other countries worldwide, Canada has been in an extended period of high inflation. Increasing interest rates lowers inflation and makes the dollar more valuable.

How Does Inflation Affect Consumers in Canada?

High inflation decreases consumer purchasing power. As a result, high inflation lessens the value of consumer income. Inflation causes prices to rise for a variety of reasons. For example, production costs become more expensive if raw materials prices increase. This extra cost, in turn, is passed on to consumers who must pay more for the same products and services.

How Does Inflation Affect Investors in Canada?

High inflation can decrease investment returns. For example, an investor may purchase bonds with fixed interest rates. However, inflation rates can outpace the interest rates on the bonds, depleting anticipated bond earnings over the term.

Like consumers, investor purchasing power also decreases. Generally, high inflation negatively impacts the stock market. So, investors must assess the overall value of their intended investments and the market and anticipate inflation rates and monetary policy enacted to combat high levels.

How Does Inflation Affect the Canadian Economy?

In Canada, inflation greater than two percent typically has negative economic impacts. Therefore, businesses must determine an appropriate strategy to help them combat inflation while maintaining their current value.

Determining such strategies is difficult for most companies, and successful strategies vary between industries. Consumers may also change the products they commonly use, opting for cheaper alternatives to brand-name products. Not to mention, borrowers will struggle to find low rates since issuing credit becomes more expensive for lenders during periods of high inflation.

The Best Investments During Periods of High Inflation in Canada

If you look online, you will find nearly every opinion regarding investing during periods of high inflation. Depending on who you talk to, you’ll get a different answer for the best investments and hedges. Here are a few common ways people invest during these challenging times.

Stocks

Stocks in companies with strong and sustained performance over long periods are ideal hedges against inflation. Okay, they’re not sexy investments. But they’re what made Warren Buffet wealthy. Even off-brands have market performance. If you anticipate that off-brands will see higher earnings levels due to consumers shifting to cheaper products, make the shift with them. When inflation decreases, move with the market.

Warning: Do not invest in everything you read about on the internet. There is a ton of self-interest floating around in cyberspace. And it’s why you’ll never read specific investment advice from us. We’re just good at economics, and that’s the lane in which we stay.

Real Estate

Real estate investments are generally long-term investments. As of writing, the Canadian real estate market has taken some big hits. So, if you have some cash (or access to reasonably priced financing), it might be time to hedge inflation’s effects with residential or commercial properties. Rent prices are climbing. It is customary to increase rates yearly if you act as a landlord.

If you don’t have the capital to buy a profitable property, you might consider investing in a real estate trust. With these trusts, you have shared real estate ownership with other investors.

Precious Metals

Precious metals have proven their worth as hedge investments time and time again. Precious metals are highly resilient to increases in inflation, but they don’t offer any form of passive income like stocks or real estate (e.g., no dividends or rental income).

Cryptocurrency

No. Do not even think about it.

What Businesses do Well even During High Inflation?

Whether you’re looking to start your own business or deciding on stocks to add to your portfolio, it is crucial to understand what types of companies are likely to succeed during high inflation. According to Warren Buffet, to find business success during high inflation, you need to increase your prices without resulting in significant buyer loss. Or you must generate the same profits with lower margins. It is that simple.

Strong Consumer Following

Businesses that can quickly increase prices and maintain their current market share are precious and resilient to inflation. These businesses combat inflation by increasing their prices to maintain the same level of profitability. Apple is an excellent company that can raise prices without substantial market share losses. The first iPhone originally sold for $499 for the 4GB model. The iPhone 13 Pro starts at $999. This doesn’t even include all the add-ons offered now compared to when they started.

Even with this massive price change, Apple has managed to maintain its profitability and grow. Due to many factors, Apple can sustain consumer transactions even with price increases. Their buyers are so loyal that changes in the prices of Apple products (within a reasonable range) are unlikely to deter them from continuing to purchase the latest product releases.

Strong User Adoption

Major software companies can charge their users more during inflation in Canada. Strong user adoption means that users are most comfortable with a particular software company’s product and are unlikely to leave the product for a cheaper option.

Businesses that generate the same profit with lower margins are also extremely valuable during periods of high inflation. One of the best examples of a company that functions like this is Meta (e.g., Facebook, Instagram, WhatsApp). When inflation is high, Meta simply increases the number of ads shown to its users to combat the adverse effects. As a result, users are unlikely to stop scrolling due to increases in ad frequency. Still, the company can maintain the same profit even if the ads are worth less than before.

Specific sectors such as healthcare, finance, wine, and energy, for example, are also suitable investments to explore. These, among other sectors, continue to perform well during high inflation.

What Businesses Don’t do Well During Periods of High Inflation?

The businesses that get hit the hardest during periods of inflation are usually those that profit from discretionary consumer spending. For example, the automobile industry often takes a big hit. When inflation is high and money value lessens, people are less likely to go out and buy a new car unless they need to. This cuts into a considerable section of automobile sales.

When fewer consumers are seeking the product of a company that is increasing its prices to make up for the difference, it isn’t sustainable. Such companies will struggle when there is high inflation in Canada.

What is the Best Protection Against Inflation?

According to American business magnate Warren Buffet, investing in yourself is the best protection against inflation. Unfortunately, since it’s challenging to be a good investor during these times, increasing your earnings is the most surefire way to beat inflation.

Investing in yourself allows you to maintain the same buying power. This means increasing your income through learning new skills in your current job, starting a new job with a higher salary, or starting a side hustle. Then, after the period of high inflation has settled, you come out on top.

Before You Start Investing

Before you start sifting through the stock market to find high-risk, high-reward investments, you should be very confident in your financial status. As consumers, investing in an unpredictable economy is hazardous if your finances are not in order. Many of the wealthiest people in Canada had declared bankruptcy when their risky investment decisions caused their financial situation to crumble.

Preparing for unpredictable economic conditions is essential to maintaining a comfortable emergency fund and having a strategic investment plan. The best investors are proactive, not reactive, to the significant movements in the economy.

What better way to start preparing for your financial security than monthly encouragement straight to your inbox? So sign up for our browser alerts or monthly newsletter today to get the latest financial guidance.