Having life insurance and critical illness insurance is vital for families. PolicyMe makes obtaining a competitive and reasonable quote convenient without talking to someone in sales or an agent. If you require life or critical illness insurance, PolicyMe is here to help!

It is now easier than ever to be insured and have financial security thanks to PolicyMe’s straightforward online application process. You can get an instant quote in 30 seconds, and if approved, you can quickly fund your policy through a bank transfer or credit card. This way, you and your family are protected from tragedies like death and severe illness.

Fast and affordable life and critical illness insurance

PolicyMe is a fast and affordable way to buy life and critical illness insurance.

Creditpicks

Tweet

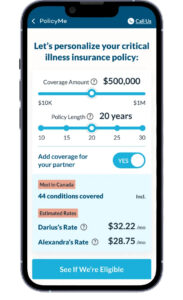

With PolicyMe, you can quickly get a quote for an affordable policy in mere minutes (PolicyMe, 2023). All you need to do is fill out their secure form, which only takes 15-20 minutes. Furthermore, you can add extra critical illness coverage to your policy.

Term life insurance with no medical exam

Canadians seeking financial security without a long-term commitment should consider purchasing term life insurance. Term life insurance is cheaper than a permanent policy and may not require a medical exam. In addition, most of PolicyMe’s insurance policies don’t need a waiting period.

Secure and fast insurance application process

You can quickly and easily receive a life insurance quote from PolicyMe without sharing your personal information with someone in person. All you do is fill out their secure application form, and you’ll have your final quote in no time. You can quickly and easily receive a life insurance quote from PolicyMe without sharing your personal information with someone in person. All you do is fill out their secure application form, and you’ll have your final quote in no time.

Add critical illness insurance anytime

With PolicyMe, you will always be able to have the most comprehensive critical illness protection available in Canada (PolicyMe, 2023). This adds an extra layer of security. Your family will also have the financial means to handle hospital expenses, rehabilitation, home care costs, and long-term care if necessary if an illness or injury arises.

Manage your family’s financial security in one place

With PolicyMe, you can easily manage all aspects of your family’s financial security in a single, convenient location.

PolicyMe also provides helpful resources and support, so you can make informed decisions and ensure your family is protected.

Protect your information

Answer some general questions about yourself and choose the level of coverage you want, and PolicyMe will take care of the rest!

Protection from the unexpected

PolicyMe offers a variety of affordable life insurance and critical illness insurance plans to meet your needs and budget. Their plans comprehensively cover unexpected events such as death, critical illness, and financial loss. PolicyMe makes getting the coverage you need easy and affordable.

PolicyMe’s life insurance plans start at just $20 per month, with flexible payment options to make sure you can find the right plan. PolicyMe lets you know that your family is taken care of and protected no matter what happens.

To get started:

- Complete the secure application form in minutes online

- If you have questions, you can speak to an advisor over the phone by calling 866-999-7457 or emailing info@policyme.com.

- Once your application has been decided, PolicyMe will email you the outcome. In addition, they will give you the necessary instructions to make your initial premium payment.

Funding your new policy is easy

Once you’ve reviewed the quotes and decided on the right policy, fund it with a payment card. You can make any changes to your coverage within the first five years. Examples include adding coverage, increasing limits, or changing beneficiaries. These changes can be made by contacting an advisor by email or phone.

All changes can be made quickly and easily, giving you peace of mind knowing that your coverage is up to date.

Quick and easy policy changes

If you need guidance selecting the right amount of coverage for your family, please get in touch with an advisor at info@policyme.com.

Protect yourself and your loved ones today

PolicyMe protects you and your family in the event of death or critical illness. Their advisors are non-commissioned and licensed and available seven days each week.

With PolicyMe, you’ll get more coverage for less money. And there is also the opportunity to insure your children with free coverage ($10,000). In addition, couples applying can save 10% in their first year with the couple’s coverage option.

PolicyMe’s term life insurance pays out a lump sum benefit payment that is a tax-free death benefit. In addition, their critical illness insurance is also a tax-free lump sum payment.

PolicyMe’s critical illness insurance financially protects you from various health events and diseases. These illnesses include fully-covered and partially-covered conditions like cancer, aortic surgery, heart attack, stroke, dementia, blindness, and organ transplants. Medical care for these illnesses can be overwhelming, even with Canada’s universal healthcare system.

Award-winning insurance coverage

PolicyMe has earned numerous awards. These awards include the following:

- MoneySense Magazine’s 2018 Award for Best Overall Online Brokerage Platform

- Globe & Mail Readers’ Choice Awards 2017 Best Customer Service

- Canadian Business Magazine’s 2016 Top 5 Most Innovative Companies in Canada

Conclusion

If you’re looking for a way to protect your family from unexpected events like death, critical illness or financial loss, PolicyMe excellent option.

Their affordable life insurance plans are available for as little as $20 monthly. You can start today by completing PolicyMe’s application and getting a quote in minutes!