Today, there is no shortage of loan providers and options to cover debt consolidation, big purchases, and unexpected costs. The struggle now is deciding which lender can offer the best deal.

Finding the right loan option can be confusing. To make the best selection quickly, there is help available online. This platform allows individuals to compare lenders and their offers. It can be invaluable with the various terms offered for personal, bad credit, and other loans.

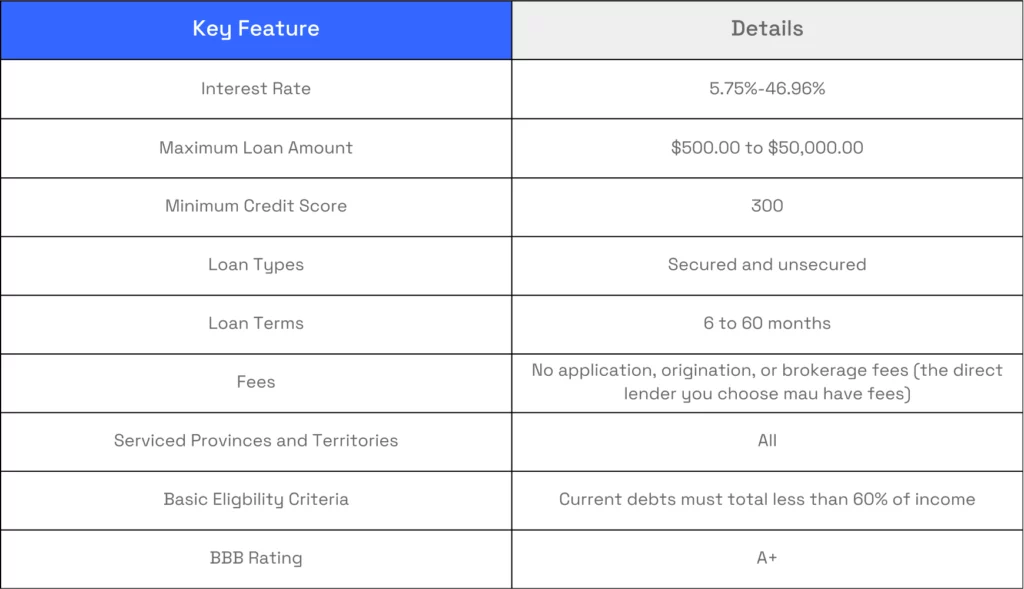

This post is a review of LoanConnect, an online loan aggregator. It details various loan types, interest rates, credit score requirements, and other associated information.

What is LoanConnect?

LoanConnect is an online tool that helps people find the right loan option for their needs. It offers various loans, including secured and unsecured personal loans. The loans can be used for multiple purposes, such as home renovation and debt consolidation.

LoanConnect serves as a bridge between borrowers in Canada and lenders, even those with poor credit. This platform allows customers to shop for the best interest rate and repayment option that suits their needs. This is a great benefit for customers.

LoanConnect is a solid alternative to conventional lending offered by other financial institutions. You can find loans in minutes, often with lower rates than banks.

The following is a complete list of LoanConnect’s features.

LoanConnect uses secure internet technology to identify the most suitable lenders based on your requirements. Once you have indicated your preferences, the system generates a list of potential matches.

After selecting a lender, you will be directed to their website to complete the loan application. After the successful application, you should expect to receive the funds in your bank account shortly.

Types of Loans Offered by LoanConnect

LoanConnect provides a comprehensive selection of loan products and services tailored to various needs in Canada, including those for typical uses. Their range of loans includes:

- Debt consolidation.

- Paying down your credit card debt.

- Completing home improvements or renovations.

- Making large purchases such as a new laptop or tablet.

- Growing your business.

- Covering medical expenses.

- Paying for a wedding.

- Buying a new car, truck, boat, or other recreational vehicles.

- Taking a vacation.

- General bills and expenses.

- Rebuilding your credit.

Once you decide which type of loan suits your needs, you should apply. You can be sure that your credit score will not be affected. LoanConnect’s lenders will use a soft credit check to determine your eligibility. This will not have any effect on your credit score.

How to Apply for a Loan with LoanConnect

After you submit your request, you can expect to be pre-approved for the loan in minutes.

To apply for a loan through LoanConnect, you will typically need to go through a few steps in the application process.

- Step 1: Decide on the type of loan and the amount of money you need.

- Step 2: Provide your identifying information, such as your name, date of birth, and contact number.

- Step 3: Provide details about your job and annual earnings.

- Step 4: Accept all policies and verify credit information. This step will not affect your credit report.

To be eligible for a personal loan in Canada through LoanConnect, your debt payments must not exceed 60% of your income. After you submit your request, you can expect to be pre-approved for the loan in minutes. Then, you will be guided to the next steps on the lender’s website.

LoanConnect’s Interest Rates

Annual Percentage Rates (APRs) offered by LoanConnect are contingent upon various factors. These factors include the borrower’s credit score, the loan’s purpose, and the lender. Canadian citizens with a low credit rating may experience a higher APR. This includes the interest rate, fees charged by the lender, insurance, and other associated costs.

The APRs range from a low of 5.75% to a high of 46.96%. Because of this wide range, comparing lenders to find the best loan options is important.

To be eligible for a loan at LoanConnect, the minimum credit score accepted is 300. However, customers have found that a score of 550 is needed to be approved for an unsecured personal loan.

People with poor credit may find it challenging to secure a loan. However, the lender is ultimately responsible for making an approval decision.

Having a good credit score can help you get approved for a loan. Those with higher scores are more likely to be approved for better loan terms and lower rates.

Available Loan Amounts and Terms

LoanConnect provides borrowers with a wide selection of loan amounts, from as little as $500.00 to as much as $50,000.00. In addition, you can use the loans for any purpose.

When looking for a personal loan, you can obtain one with a repayment schedule ranging from 6 to 60 months. However, it is important to note that the longer you extend the repayment period, the higher the interest rate will be. So it is wise to be mindful of not taking on more than you can handle.

Is there a Cost to Use LoanConnect?

Using LoanConnect does not come with any additional cost to the user. However, the service partners and lenders might incur commission fees for being able to advertise on the platform.

Different loan providers may include charges such as administration fees and loan origination fees in your monthly payments. You can check the lender’s website to determine how much you must pay for the loan origination.

It is essential to be aware of possible costs associated with a mortgage, such as insurance, appraisal fees, and other charges. Furthermore, interest rates may vary depending on location and be adjusted anytime.

Once a loan is deposited into your account, repayment typically begins immediately. Depending on your lender, there may be charges for late payments or returned payments. Examining the terms and conditions of the loan provider you choose before committing to a loan is advised.

Is LoanConnect Secure?

When managing your finances, security is an essential factor to consider. LoanConnect utilizes data encryption to keep your financial data secure and private.

Your data is securely sent to potential lenders when applying for a loan. This data transfer lets lenders see if you are a suitable match for their products. Your personal and financial information is kept confidential and only accessible for that particular transaction.

Is LoanConnect Legitimate?

Potential customers of LoanConnect often inquire about the legitimacy of the loan service before they decide to use it.

The Better Business Bureau (BBB) has given LoanConnect an A+ rating, the highest standard of legitimacy in the business world. This means LoanConnect is a legitimate company.

LoanConnect Customer Service

Most LoanConnect customers deem the customer service representatives highly competent and credible. In addition, they have earned an impressive TrustSpot rating of 9.7 out of 10.

LoanConnect offers an online loan application service. The company also has a physical office address, a contactable telephone number during business hours, and agent support via email.

LoanConnect Benefits and Considerations

Before taking out a personal loan, being well-informed about LoanConnect and its benefits and drawbacks is essential. Knowing all the information beforehand will help ensure an appropriate decision.

The followings are some benefits and considerations associated with LoanConnect. Consider these factors when deciding if it is the right fit for you.

Benefits

- Efficient customer service and advanced security.

- A thorough comparison of lenders offering unsecured loans at a glance.

- Immediate transfer of money to the customer’s bank account upon approval.

- The best personal loan rates on the market, starting from as low as 5.75%.

- High chances of approval even for customers with bad credit scores.

- Offering various loan types, including relocation, debt consolidation, and wedding loans.

- Available in all of Canada’s provinces and territories.

- 100% free to use with no specific cost.

- Loans are available in a wide range from $500.00 to $50,000.00.

- No effect on your credit score as the platform only asks for an estimate of your credit score. There is no hard credit check on your file.

- Offers secured and unsecured loans so you can apply for a loan with or without collateral.

Considerations

- This a procedure that can be done entirely online without being able to meet with a LoanConnect representative in person. However, communication can be done through emails and phone calls.

- Comparing various secured and unsecured lenders is vital to make the best possible loan decision. Unfortunately, only a small number (22) of lenders are available on LoanConnect.

- LoanConnect generally offers term loans as opposed to a line of credit. With term loans, you repay a specific amount on a set schedule. You cannot reuse any repaid amount. With a line of credit, you can pay down the credit line and then spend what you repaid again.

What Happens After You Receive Your LoanConnect Loan?

Once your loan application has been approved, the funds are transferred to your account. You must ensure that the necessary payments are made on time. This is typically done via direct debits from your bank.

Planning and making a budget are essential to cover your loan payments. In addition, you should be aware of any potential additional fees associated with your loan. These fees might be loan origination fees or fees related to making early or late payments.

Summary

LoanConnect is an online search engine that provides customers with multiple lender options to get loans for personal use in Canada. The whole process of getting the loan takes place online without the tedious routine that you may experience with banks.

It takes a short time to be approved by LoanConnect for a loan. As a result, their service is a top option for many Canadians who need unsecured loans. In addition, people love LoanConnect because the platform offers different types of loans without a minimum credit score threshold.