Technology has revolutionized purchasing a mortgage. Before, the process was tedious and laborious, requiring visits to a bank and arduous paperwork. But enter nesto: with over 1000 lenders in its database, they offer the lowest interest rates and best deals on mortgages in Canada, all done 100% online.

This post will discuss nesto’s product details, how they work, and more.

Who is nesto?

Based in Montreal, nesto is a mortgage provider offering new purchase, renewal and refinance mortgages. It raised $76 million in June 2021 to expand nationwide.

nesto is a leading provider of mortgages in Canada, offering some of the lowest rates. Their online platform provides customers with a positive, transparent, and unique experience, and they have recently started selling mortgage products.

Millennials have taken a particular interest in nesto, with 53% of the mortgage deals in Ontario in 2022 coming from this age group. Nesto provides several features to make the mortgage process easier and more accessible, including an easy-to-use calculator, a simple application form, and a team of advisors available to answer questions. They also offer various payment options and a commitment to quick turnaround times.

Mortgages in Canada: nesto's Key Advantages

nesto advertises the lowest rates, clarity, rapidity, specialist knowledge, and more. Here are the main offerings:

- Lowest rates. You can save money with nesto, and they guarantee the lowest rates in the country, offering to match or beat any rate or give you $500.

- Transparency. The buying process with nesto is fully transparent.

- On-demand mortgage advice. Get free, expert mortgage advice with no commission. Contact nesto for answers to your questions.

- Speed. Enjoy quick access to the best mortgage rates in Canada. Start an application on the website to get an instant response.

- Longest hold rate in Canada. nesto offers the most extended rate hold in Canada, 150 days, giving you security and ample time to consider debt consolidation or other money-saving options. However, don’t forget to consider the daily cost of not locking your rate, given the frequent rate hikes from banks and the Bank of Canada.

Who Uses nesto?

nesto is a Canadian-based company that specializes in helping those in Canada who want to buy, renew, or refinance a property, focusing on the provinces of Ontario and Quebec. They also cater to those in the western part of the country, such as British Columbia and Alberta.

Their primary target market is tech-savvy people aged between 26 and 45, both in urban and rural areas. They strive to provide an easy and convenient service tailored to the needs of their customers.

How Does nesto Work?

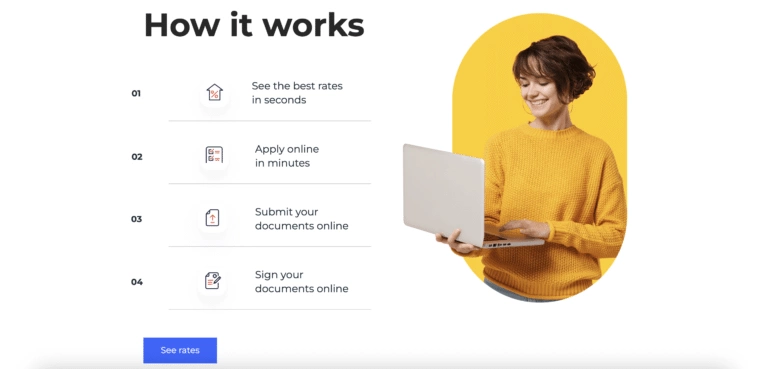

Are you confused about nesto? Their innovative process may take some time to understand but working with them is simple. After providing details like name, contact info, property cost, down payment, and timeline, you’ll receive a quote in an email with three options.

The first option is the absolute lowest rate on the market. The second option is the best offer for your money, with low rates and flexible terms. The last option is a product from one of the Big Six banks you have seen before. You can accept one of the offers immediately without speaking with an advisor.

Once you’ve seen the initial quote, you may have questions. nesto’s advisors can help – you can schedule a call to discuss your choices. They’ll take you through the online application, which requires specific data, including the following:

Ensure you have the data prepared beforehand. Then, submit your application and related paperwork. Alternatively, apply initially and attach the required documents later.

- Personal information

- Co-applicant information

- Income

- Detailed down payment information, etc.

Ensure you have the data prepared beforehand. Then, submit your application and related paperwork. Alternatively, apply initially and attach the required documents later.

How Are nesto’s Canadian Mortgage Rates so Low?

Mortgage brokers make money from commissions when they find customers to sign up with a lender. They can use this money to lower the mortgage rate. Different mortgage brokers may offer different rates from the same lender.

This is where nesto changes the game. nesto does not use a commission-based system to pay their brokers. Instead, the company provides them with a traditional salary. This way, there is no conflict between the broker’s income, and they are finding the lowest rate for a nesto customer.

nesto’s working system ensures buyers are always getting the lowest rates instead of the rate a traditional mortgage broker typically gives them.

150 Days: The Longest Hold Rate in Canada

Gaining pre-approval for a mortgage can be advantageous because it helps you identify what you can afford, strengthens your position with sellers, and allows you to determine the precise amount of your loan. As a result, most lenders, particularly the Big Six banks in Canada, provide pre-approval.

nesto provides a remarkable 150-day rate lock on pre-approved mortgage rates – the longest in the country. Other banks offer only 90-120 days, making nesto stand out. This means your quoted mortgage interest rate will remain the same for five months, even if the prime rate rises. This is particularly beneficial in a volatile housing market, protecting you from higher mortgage payments.

nesto’s Mortgage Switching Assistance

nesto helps you switch mortgage providers when it’s time to renew or refinance your mortgage. To get started, simply fill out the online application. nesto recommends submitting your application up to five months before your current mortgage term ends. This will allow you to take advantage of current rates and be prepared to switch providers when the time comes.

Consider if switching providers is worth the cost, particularly before the loan term’s end. Most partners of nesto will cover transfer and notary fees, while breaking the current contract can incur hefty fees not covered by the new lender. Speak to a nesto advisor to determine if switching is a good idea, taking all costs into account.

nesto Mortgage for New Canadian Residents

Immigrants in Canada often encounter difficulties obtaining their first home due to a lack of Canadian credit, savings, or employment history. Luckily, nesto has created a program tailored to Canadian newcomers, with around 20% of new mortgages associated with them. To assist immigrants in meeting the Canadian mortgage criteria, nesto has different qualifications.

To qualify for nesto’s program, you must have 3+ months of Canadian full-time work experience plus a valid work permit or PR. In addition, documents showing income, bank statements and international credit reports/rent/utilities are needed. Even 5% down may qualify you for a nesto mortgage.

Why Should Canadians Use nesto?

With all the benefits of nesto mentioned in this post, it is easy to assume that the company is revolutionizing the mortgage industry. Some of the features that make nesto stand out are:

- They offer the lowest rates. Period.

- They pay their brokers a salary instead of by commission.

- They are the only mortgage lender in Canada with fully remote offerings. This eliminates trips to crowded banks for potentially intimidating meetings.

- They provide a streamlined digital process with quick turnaround times for approvals (sometimes even as short as 24 hours).

nesto x Creditpicks

Did you know that nesto has teamed up with Creditpicks to offer our users the very best mortgage search, pre-approval, approval, and funding experience? nesto even offers significant cash back on every funded mortgage. This cash is for you to use for anything you want.

Final Thoughts

nesto provides the fastest mortgages and lowest rates in Canada. Its modern business model and focus on customers are becoming increasingly popular. By working online and teaming up with leading lenders, nesto delivers quick turnarounds and the longest pre-approval rate lock in the nation. Try it for yourself and see the difference!

Of course, maintaining a solid personal financial position doesn’t end with a mortgage. Creditpicks offers Canadians information and services that enhance their economic well-being. So, whether you’re looking to create a budget, buy a car or secure insurance of nearly any type, Creditpicks is here to help. Subscribe to our blog and get one year of free access to your TransUnionⓇ report.