Neo Financial is a Canadian FinTech company founded in 2019 by four talented entrepreneurs: Andrew Chau, Chris Simair, Jeff Adamson, and Kris Read. Based in Calgary, the company offers various financial products and services, including Neo CardTM, Neo Secured Card, Neo MoneyTM, Neo MortgageTM, and Neo InvestTM.

Neo Financial has over seventy-five accomplished employees and a $1 billion valuation. They have also gained a 4.8-star rating on Apple’s App Store. The company’s primary goal is to reshape how Canadians save, spend, and earn rewards by helping them make the most of their investments and partnering with some of the most well-known brands in Canada.

Neo Financial stands out because the company has successfully attracted 1 million customers in three years. This post covers all the top products and services offered by Neo Financial.

Neo CardTM

Neo Card Rewards

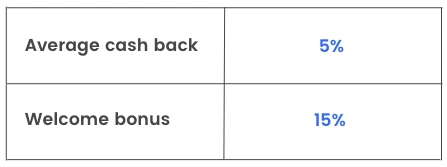

Neo has partnered with over eight thousand retailers to provide customers using their Neo Card with extra cash back when shopping. You must use your card to shop in one of the retail partners and enjoy an average of 5% cashback.

Here are some of Neo’s partners, along with the cash back you earn from them:

- Canadian Tire: 2%

- Sport Chek: 2%

- Loblaws: 1%

- Shoppers Drug Mart: 1%

- Walmart: 1%

- Amazon: 2%

One thing to remember is that the amount you can earn in one transaction is usually limited. For example, Amazon usually provides 2% cash back, up to $50. Therefore, you can spend as much as $2,500 at Amazon and still get 2% cash back ($50). But it is a significant transaction for a single purchase.

You can also enjoy 15% cash back on a first-time purchase.

Neo Financial Hudson’s Bay Mastercard

The Hudson’s Bay Neo Card offers up to 20% off on first-day purchases and earns you double the points at Hudson’s Bay stores and thebay.com. Plus, you earn points everywhere else you shop and receive an average of 2% cash back at thousands of Neo partners.

Redeem Rewards Any Time

Most credit cards offer rewards only once per year at a specific time. However, Neo Card lets you redeem rewards whenever you like, with no minimum redemption amount.

Even better, you can choose how you want to redeem your rewards. For example, you can use your cashback towards your statement credit, add it to your Neo MoneyTM or Neo InvestTM account, or cash out at their merchandise store.

Neo Financial Has No Annual Fee

As a Neo Card holder, you do not pay an annual fee. Everything you earn stays in your pocket.

Even if you need to test other Neo perks, you do not have to pay the annual fee. But you can upgrade your Neo Card to include various additional benefits by paying a monthly fee. In addition, you can unsubscribe anytime and switch to the regular no-fee card without penalty.

Neo Financial Has Low Credit Score Requirements

Some credit cards require a minimum score of 660 for eligibility, while others need even 725 or higher. However, Neo requires you to have a credit score of at least 600 to become eligible for their cards.

So if your score is low, the Neo Card is your option. You can take advantage of exceptional rewards on your purchases while you build up your credit.

High Welcome Bonuses

You can enjoy up to 15% cash back on your first purchases from many of Neo’s partners. This bonus makes for easy money for new Neo Card holders.

Things to Watch Out For

Despite all the advantages mentioned, Neo Card has a couple of downsides that are worth considering.

First, the no annual base fee card offers no insurance coverage. Even basics such as extended warranty and purchase protection are not covered, let alone travel insurance. However, you can upgrade your card to include these benefits by subscribing to one of their various add-on perks.

Some rewards are also limited. Unsurprisingly, purchasing from non-partner retailers with Neo Cards results in no rewards. Also, many partner retailers have limited cash back in every transaction.

Neo CardTM (Secured)

Neo Secured Card is one of the best ways to rebuild your credit score. With this card, you can earn plenty of rewards on purchases and pay no annual fee. In addition, the Neo Secured Card offers the same perks as the Neo CardTM, including making cash back at over 8000 Neo partners.

Getting a Neo Secured Card

When you apply for a Neo Secured Card, the good news is that Neo will not conduct a hard credit check and you are guaranteed approval. Therefore, you do not need to worry about a credit check shown on your credit file.

After you complete your application, Neo asks you to provide a security fund to get a card issued. Although you need to provide $500 for most secured cards, you only need $50 for Neo’s card. This feature makes it the best secured credit card in Canada.

Similarities with Neo Card

The Neo Secured Card offers all the same perks as the Neo Card, including:

- Rewards: 15% cashback on first-time purchases and an average of 5% cash back at partner retailers.

- On-Demand Redeem: You can choose when to redeem your reward with no minimum redemption amount.

- No Annual Fee: Although no-fee secured cards are rare, Neo does not charge you an annual fee.

- Welcome Bonuses: 15% back on first purchases from select partners.

- No Insurance Coverage: Neo Secured Card does not include insurance coverage, which is typical for secured credit cards.

Neo MoneyTM

Neo Money is one of the best high-interest savings accounts in Canada. Neo Money features 2.25% interest on every dollar in your account (much more than all the big banks)—with no fees whatsoever.

Whether transferring money between banks, paying a bill, or sending an Interac® e-Transfer, Neo Money offers free unlimited transactions. It would help if you remembered that this account does not have a debit card, though you can access it using Neo’s mobile app.

High-Interest Rate of up to 2.25%

Earn up to 2.25% on every dollar in your Neo Money account. This figure might not seem like a lot, but it adds up quickly. Furthermore, it is free money—what is better than that?

No Transaction Fees

You generally have three options for transactions using your Neo Money account. They include the following:

- Make a bill payment

- Send and receive Interac® e-Transfers

- Make bank-to-bank transfers

Regardless of your choice, you do not need to worry about fees; everything is free and unlimited.

No Monthly Fees

There are no fees to keep your Neo Money account open and active. So you don’t need to worry about getting dinged every month or year to maintain your savings. This feature might seem relatively standard for a saving account, but the addition of the high-interest rate and unlimited free transactions makes this worthwhile.

The CDIC Deposit Protection

Because Concentra Bank, which is a member of CDIC, provides Neo MoneyTM accounts, your deposits are eligible for free protection. In addition, up to $100,000 of your money (combined between both banks) is covered in the unlikely event that either bank faces liquidity issues.

Things to Watch Out For

While a Neo Money account comes with many benefits, you should consider a couple of downsides.

- No Debit Card: There is no associated debit card with a Neo Money account, though Neo alternatively offers no-fee credit cards with extra cash back.

- Unavailable in Quebec: Residents in Quebec are unfortunately unable to use a Neo Money account, though the company plans to make it available soon.

Neo MortgageTM

Neo has recently entered the mortgage space. The company operates a platform to help customers compare mortgage rates offered by other services. In addition, Neo offers expert advice and incentives to help you close your deals online.

Advantages and Major Differences with Traditional Banks/Brokers

There are some significant differences between Neo Mortgage and banks and traditional lenders. Here are these differences, along with all the benefits of Neo Mortgage:

- Completely Digital: Neo Mortgage works all online, meaning you can stay home and upload your mortgage documents, work with a lawyer, and sign your closing papers.

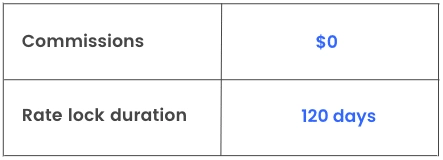

- No Commissions: Neo Mortgage representatives do not take commissions and try to work in your best interests with transparent quotes.

- Best Rates: The platform finds the best rates with available partners. You can even lock your rates in for as long as 120 days.

- Fast Application: The application process lasts only 5 minutes. You are instantly pre-qualified and can see your anticipated approved budget and interest rate.

- Dedicated Support: All applicants get an expert human associate with no commissions.

- First-Time Purchase: You can purchase your first house with flexible terms and as little as 5% down.

- Renewal: Neo Mortgage offers 500% fewer penalties than traditional lenders to move or change your mortgage and allows 20% annual lump sum payments so you can repay your mortgage sooner.

- Refinance: Neo Mortgage’s experts can help you manage your finances to consolidate your debts to pay them off sooner, access cash to complete home renovations, and redistribute equity to invest in other assets.

Neo’s Partners

Neo Financial works with some of Canada’s largest, independently-owned mortgage service companies.

CMLS, Strive, Home Trust, Optimum, and many other reputable lenders are among the mortgage service companies partnered with Neo. You can request a quote online or contact Neo to find out who they work with.

Required Fees

Neo Mortgage does not charge you fees or commissions to close your mortgage, meaning the service is free. However, you might need to pay fees to your lender.

Depending on the lender you choose, there will be different fees for your Neo Mortgage deal. These fees include the following:

- Origination Fees: Required to set up or maintain your loan.

- Closing Costs: Third-party fees or services needed to get a mortgage, including appraisals and title insurance.

- Early Payment Fees: Required to make early repayments on your loan.

- Late Payment Fees: Additional fees should you have a late or wholly missed payment.

Things to Watch Out For

Despite all the benefits of Neo Mortgage, there are a few factors to consider when applying:

- Select Lenders Only: Neo Mortgage works with limited lenders. Therefore, you may miss out on some better deals.

- 100% Digital is Limited: You can use the service 100% digitally only in Ontario, Alberta, and British Columbia.

- No In-Person Service: You cannot visit the Neo Mortgage team to discuss your mortgage. It would be best if you were comfortable with the fully digital system.

Neo InvestTM

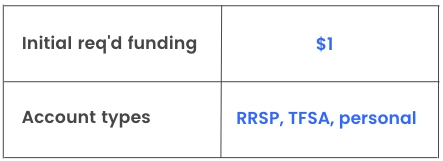

Neo Invest – powered by OneVest – is the private wealth management tool for all of Neo Financial’s customers. The platform offers you professionally managed investment portfolios customized for you. You may start using Neo Invest with as little as $1. In addition, you may personalize your portfolio to your values or access themed portfolios.

Invest Like the 1%

Neo Invest helps you invest like the ultra-rich. In other words, Neo Invest provides you with a versatile portfolio to achieve your goals and manage risk. However, you should not put all your eggs in one basket, just like wealthy investors do.

Invest Per Your Goals

With Neo Invest, portfolios reflect your life and needs. To do this, they are created based on your risk tolerance, financial situation, goals, time expectations, and general knowledge of investments.

More Diversity

Neo Invest provides you with up to three times more asset classes and investment strategies to balance your portfolio risk and protect you from sudden changes in the market.

Different Account Types

With Neo Invest, you can choose accounts that include the following:

- RRSP (Registered Retirement Saving Plan): Best for those trying to save for retirement and who need the benefits of tax write-off contributions.

- TFSA (Tax-Free Savings Account): Your everyday investing account with tax-free earnings.

- Personal: Investing account with no contribution limits.

The Investment Process Steps

Investing with Neo Invest is simple and easy. However, since not everyone uses the same investment strategies, Neo initially asks you about your goals to create a truly curated investment portfolio.

When ready, you need to add funds (as little as $1) or transfer your current investments into your new portfolio. Then, you can sit back and leave the rest to Neo. But, of course, you should always check in on your investments and apply changes as needed.

Our Assessment

Neo Financial is a fantastic company offering a wide range of financial products and services that are highly competitive in the market. In addition, they provide excellent customer service and maintain a strong national reputation.

What makes Neo Financial unique is that the company caters even to those with poor to bad credit scores, unlike many banks. So people who do not have a chance to save and invest can manage their wealth with the help of Neo Financial.

With all the advantages mentioned above, we assess that Neo Financial is suitable for every Canadian, whether looking for credit, a mortgage, or a high-yield savings account.