Recent studies show that 32% of Canadians aged 45 to 64 have no retirement savings. Unfortunately, without investing in your future, it’s hard to maintain a desirable standard of living once you retire. Whether you’ve just accepted your first job or are nearing retirement, knowing which longer-term savings plans will benefit you the most is essential.

A Registered Retirement Savings Plan (RRSP) is a retirement plan registered to The Canada Revenue Agency (CRA) and designed to maximize savings through income tax deferral and tax-free investment growth. RRSPs are one of many retirement savings and investing accounts available to Canadian and self-employed employees.

Planning for retirement can be overwhelming, so we’re here to help. Registered Retirement Savings Plans allow you to save for retirement while decreasing your current taxable net income. Continue reading to learn the basics of an RRSP and determine if it’s the right fit for your financial goals and future.

How is an RRSP Different from Other Retirement Plans?

The main differences between an RRSP and other retirement plans revolve around tax implications. Unlike other retirement accounts, RRSPs allow you to defer some of your income taxes to a future year. Until that time comes, your annual investments grow tax-free in your account.

RRSPs are the primary choice of retirement plan account for Canadians who expect to be in a lower tax bracket when they withdraw compared to when they contribute. Most people have a lower taxable income during retirement than in their working and saving years. If you find yourself in a similar financial situation, RRSPs will likely have a much better after-tax result than a Tax-Free Savings Account (TFSA).

TFSAs are also registered to The CRA and can benefit those in a lower tax bracket relative to where they expect to be during retirement. For this reason, it is essential to consult a qualified financial advisor or accountant to determine which retirement plan is best for you.

It is important to note that an RRSP is not an investment itself. Instead, it is an account given special tax considerations from The Canada Revenue Agency.

Benefits of an RRSP

There are plenty of benefits to opening a Registered Retirement Savings Plan. Each feature will be more beneficial the longer you have the account. The sooner you start, the more tax-free compounding you get!

Tax-Deferred Savings

The funds you contribute to your RRSP are exempt from being taxed the year you contribute. If these investments remain in your RRSP, they can grow with the tax-deferred. Essentially, investing in an RRSP allows you to postpone paying taxes on your contributions until you withdraw them.

Tax Deductions and Optimized Deductions

Any contributions you make to your Registered Retirement Savings Plan within your deduction limit are tax-deductible. This means you can deduct the amount contributed to your RRSP from your taxable income when you file taxes for the relative year.

Over the lifetime of your contributions, this may reduce the total amount of income tax you pay. RRSPs operate under a carryforward rule: If you don’t make the maximum contribution to your RRSP each year, you can carry forward a portion of the unused allowance for future years. You might consider deferring some of your contributions if you expect to have more income in higher tax brackets the following year.

Income Splitting

Generally, the more income you make, the more tax you pay. However, in a spousal or common-law partner RRSP, the higher-income spouse can share up to 50% of their eligible pension income with their lower-income spouse in a lower tax bracket.

Financing Your Home or Education with RRSP Contributions

Through the Home Buyers’ Plan and the Lifelong Learning Plan (LLP), you may withdraw money from your RRSP without immediately paying taxes if you use the money to buy your first home or pay for your education. For a down payment, you are allowed to take out up to $25,000; for education costs, you may take out up to $20,000. If you pay the money back within the specified period, you can continue to defer your tax payments. Think of it as a loan to yourself from your retirement savings account.

When Should I Open an RRSP?

While some financial institutions may require customers to be the age of majority, there is no minimum age required to open an RRSP. When it comes to saving for retirement, time is in your favour. The longer your money compounds, the faster it grows. Consider the following scenarios.

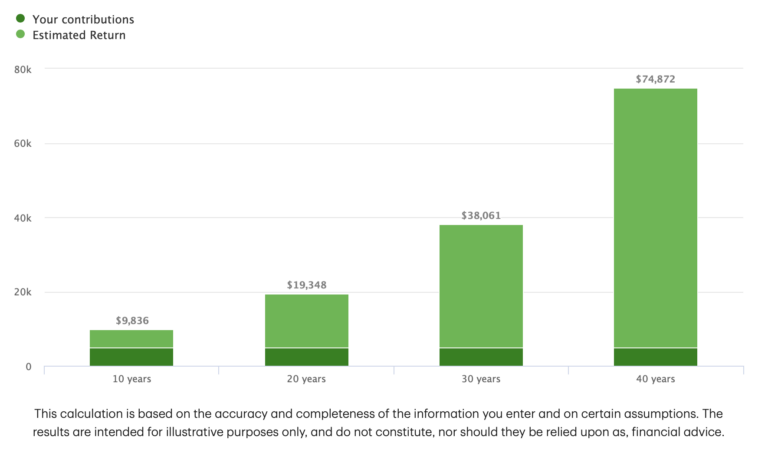

Scenario A: You deposit $5,000 into a retirement account at 25 years old, with a 7% average annual rate of return on your investments. At 65, your initial investment will have compounded 40 times. Without ever contributing another dollar, your account will be worth almost $75,000 by the time you retire. See the graph below for a visual representation of this scenario.

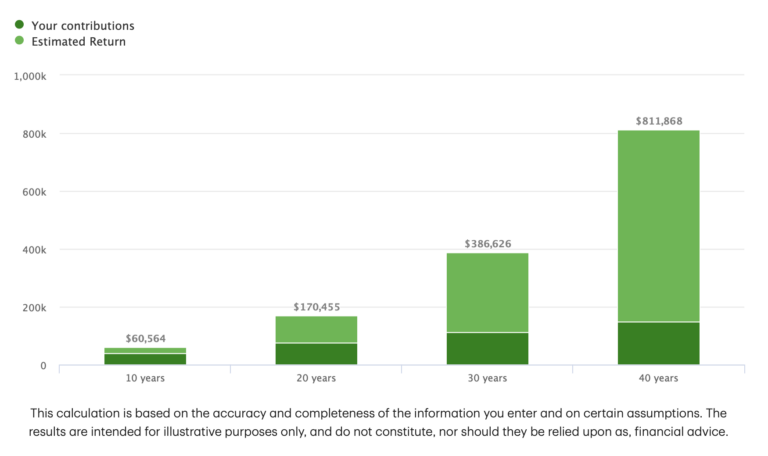

Scenario B: What if you make $300 monthly deposits in addition to your initial $5,000 investment? All other things being equal, your account will be worth around $812,000 by retirement.

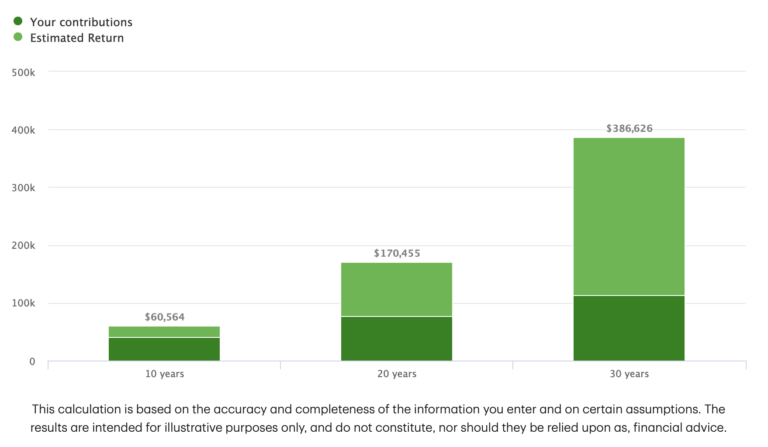

Scenario C: You wait until you’re 35 years old to start saving for retirement, all other things being equal. By the time you retire, your final account balance is only worth around $387,000. You’ve slashed your future savings by over half by waiting ten years to start!

The moral of the story: time is the greatest benefactor to your investments. Start contributing to your retirement savings as early as possible to maximize future benefits.

How Do I Set Up an RRSP?

Canadians can set up a Registered Retirement Savings Plan through a bank, credit union, trust, or insurance company. There is no minimum age to open an account, though your financial institution may require participants to be the age of majority. It is essential to consult a financial professional to determine which type of RRSP will provide the best tax benefits for you. Once you’ve concluded which plan suits you best, you can open your account and begin investing directly through your issuer. We recommend Questrade or CIBC as great options to set up your RRSP account.

Individual RRSPs

An individual RRSP is registered only in your name, comprised of only your investments. Withdrawals from this account are made only by the individual who owns it. You can choose a self-directed RRSP if you want to build and manage your investment portfolio on your accords. Alternatively, you may choose to work with a qualified financial advisor.

Spousal or Common-law Partner RRSPs

If eligible, you may want to set up a spousal or common-law partner RRSP to ensure you receive maximum tax benefits during retirement. This is an account that you and your spouse can contribute to. Once you retire, your income can be split evenly between you. If you are in a higher tax bracket than your spouse, setting up a spousal RRSP will result in a combined income tax lower than what you would pay from the income of an individual RRSP.

Group RRSPs

Many employers offer this type of retirement plan as an employee benefit. To open a Group RRSP, you will open an individual RRSP but make contributions through your employer. Your employer deducts these contributions from your paycheck, typically matched or added to. The employer generally handles management fees, while you handle investment fees.

What Type of Investments can I Make in an RRSP?

Registered Retirement Savings Plans offer a wide variety of investment options. You have many investment choices based on the type of plan you choose, your risk tolerance, and your financial goals. For example, you may hold cash or use your RRSP as a savings account. Generally, RRSPs are best suited for long-term investments such as mutual funds, ETFs, Guaranteed Investment Certificates, and Government and Corporate Savings Bonds.

Mutual Funds

Here, you can invest in funds pooled with money from a group of investors and managed by professionals. The money gets invested in a select group of stocks, cash, bonds, and other funds. Mutual funds are “open-ended,” meaning additional units or shares are added as more people invest in the fund.

Exchange-Traded Funds (ETFs)

These funds are traded on a stock exchange, allowing you to invest in a portfolio with the same investments as a stock or bond market index. Some investors choose ETFs over Mutual Funds because the management fees are usually less expensive.

Guaranteed Investment Certificates (GICs)

These low-risk certificates are sold by Canadian banks and trust companies, offering a guaranteed rate of return over a fixed period. To a degree, these certificates are insured by the Canadian government. By purchasing a certificate, you agree to deposit your money for a specified time. Interest rates vary on the length of time the issuer holds your deposit.

Government and Corporate Savings Bonds

These bonds are guaranteed investments where you can loan money to a government or company and earn a fixed rate of return. Both federal and provincial government savings bonds are available to purchase.

How Much Can I Contribute to an RRSP?

Your RRSP contribution or deduction limit determines your contribution to an RRSP. This is also known as your “contribution room.” The contribution room typically rises each year. For example, the RRSP contribution limit for 2022 is 18% of your income or $29,210, whichever is less. If you have any unused deduction room from the previous year, you may add that to your deduction limit. Once you start receiving a pension, there are additional calculations involved. Your specific limit can be found at the bottom of your Notice of Assessment or Reassessment.

How Can I Make Withdrawals From my RRSP?

Unlike other retirement accounts, you can take money out of your RRSP anytime. There are no penalties or restrictions. What is the caveat? You do not get back any contribution from withdrawals, and you must pay the income taxes you would have paid on the money had you not contributed it to your RRSP.

This account is designed for long-term investments. Making early withdrawals can reduce the overall value of your retirement account.

What Happens to my RRSP When I Retire?

If you have contribution room, employment income, and file a tax return, you can continue contributing to your RRSP until December 31st of the year you turn 71. At the end of that year, your RRSP will collapse.

Once you are no longer eligible for an RRSP, you have a few options for what to do with the money in your account. No matter how long away retirement may be, it is essential to plan and determine your best retirement options.

Withdraw Your RRSP Funds in a Lump-sum

You can withdraw the total amount of money, also known as a lump sum withdrawal, from your RRSP account. This money is subject to withholding tax. The full amount is considered income and must be declared the year you withdraw. Depending on how much money you allocate to your RRSP, that can be a large tax bill!

Transfer your RRSP Funds to a Registered Retirement Income Fund (RRIF)

When you collapse your RRSP fund, you may open a Registered Retirement Income Fund (RRIF). This type of account has a minimum annual withdrawal, an amount determined by a formula that considers both the value of your account and your age. A year after establishing this account, you will receive the minimum payment yearly. Taxes must be paid on the income you receive from this account, filed as income tax for the year you receive the payment.

Purchase an Annuity

Another option when closing an RRSP is to purchase an annuity and receive guaranteed consistent income for life or a specified period. Just as transferring funds to an RRIF, tax is not withheld on the money you use to purchase an annuity. However, when you receive income from an annuity, you will report that amount on your income tax statement for the year you receive it.

Make your Future Self Proud!

Remember, it’s never too early to start saving for retirement. Whether you open a Registered Retirement Savings Plan or choose a different route, it is vital to research all your options. Your future self will thank you!

The 2024 RRSP contribution deadline is March 1st, 2025.

For information on other retirement plans, check out our blog on responsible investing!